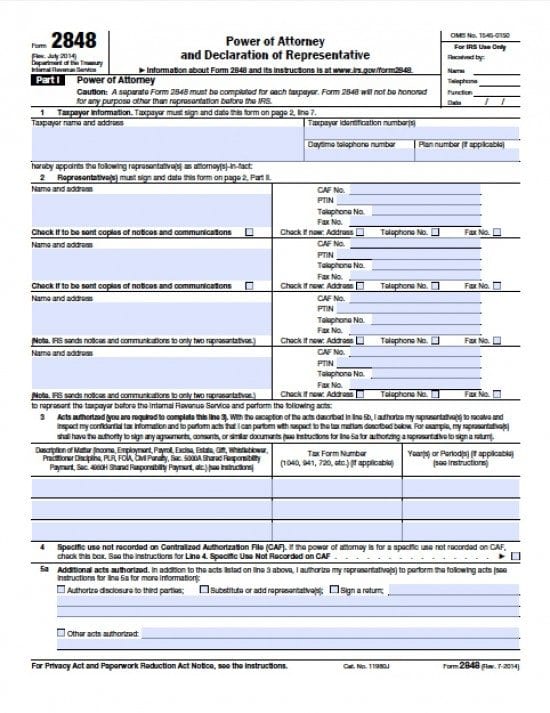

| Wyoming Tax Power of Attorney Form |

The Wyoming tax power of attorney form is a form that is used by taxpayers to authorize an tax business entity or individual to professionally prepare their tax documents and/or represent the taxpayer before a Department of Revenue, if required. The document will allow any appointed Agent(s) to request and review the taxpayer’s confidential financial information and sign tax documents on behalf of the taxpayer(s).

This document will revoke all previous tax powers documents, unless otherwise stated by the taxpayer. This document may be revoked at the taxpayers discretion. Signatures of all parties must be entered or the document will be returned, causing delays in processing.

How to Write

Step 1 – Taxpayer Information –

- Name and address

- Taxpayer identification numbers

- Daytime telephone number

- Plan number (if applicable)

Step 2 – Appointment of Agent(s) – All agent’s information must be entered as follows:

- Agent(s) names and addresses

- Check the box indicating whether or not the Agent is to receive copies of notices

- CAF number

- PTIN

- Telephone number

- Fax number

- Check any applicable boxes if any or all of the information is new

Step 3 – Authorized Acts – The Principal must complete the following:

- Description of Tax Matters (see examples on the form)

- Tax Form Number (if applicable)

- Year(s) or Period(s)

- Should the document be of specific use that isn’t recorded on CAF, check the box

- Indicate additional authorized acts by checking any applicable boxes and entering any specific information

Step 4 – Unauthorized Acts –

- If the taxpayer would like to limit authorization, enter any exemptions in the line provided

Step 5 – Retention/Revocation of Previous Powers –

- Should the taxpayer prefer to allow any prior powers document to remain in effect, check the box

- Taxpayer must attach a copy of the document to remain in effect, to this document

Step 6 – Taxpayer’s Signature – Submit the following:

- Taxpayer’s signature

- Printed name

- Date of signature in mm/dd/yyyy format

- Title (if any)

- Print the name of the taxpayer from line one (1) if this is other than the individual

Step 7 – Agent’s Declaration – Submit Agent(s) information in the table below:

- Agent(s) must read and agree to the declaration

- Provide Agent designation – indicate by entering one letter A-R

- Agent’s licensing jurisdiction (state)

- Agent’s licensing or certification information

- Agent(s) must enter their signature

- Date signature in mm/dd/yyyy format