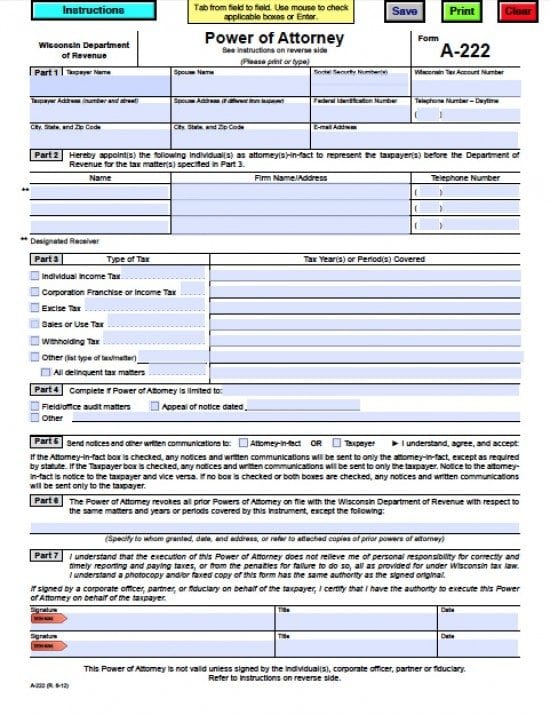

| Wisconsin Tax Power of Attorney Form |

The Wisconsin tax power of attorney form is a legal document in which a taxpayer would have the ability to authorize a delegated Agent to complete their tax forms or, if required, the Agent would have the ability to represent the taxpayer before a Department of Revenue. This document will revoke all previous tax powers documents. This document may also be revoked by the taxpayer at their discretion.

How to Write

Step 1 – Taxpayers Information – Enter the following information:

- Taxpayer name

- Spouse’s name

- Social Security number(s)

- Wisconsin tax account number

- Taxpayer’s address

- Spouse’s address if different

- Federal Identification number

- Telephone number

- City, State, Zip Code

- E-mail address

Step 2 – Appointment of Agent – Enter the following Agent information:

- Name(s)

- Firm Name/Address

- Telephone Number(s)

Step 3 – Tax Information – Check the applicable boxes and enter the following:

- Type of Tax

- Tax Years or Periods to be Covered

Step 4 – Limited Powers – Complete if powers are limited –

- Check the applicable box

Step 5 – Notices and Communications –

- Check the box that applies

- Read the remainder of the section

Step 6 – Powers Revocation Exceptions –

- Enter any prior tax powers document to remain in effect

- Specify to whom the powers were granted

- Date of execution of the previous document(s)

- Address

- Attach copies of the document to remain in effect

Step 7 – Signatures – Agent(s) must review this section and submit:

- Agent(s) signature(s)

- Title(s)

- Date(s) of signature(s)