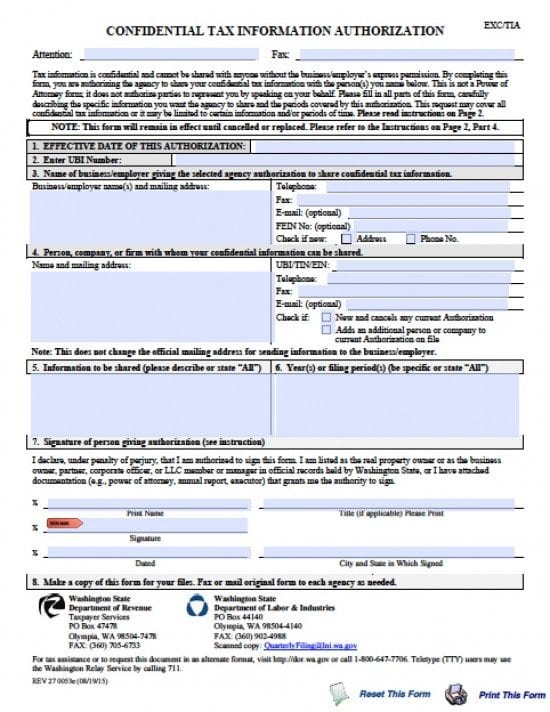

| Washington Tax Power of Attorney Form |

The Washington tax power of attorney form is a document that is provided by a taxpayer to an individual or tax professional, to authorize their ability to request and receive a taxpayer’s confidential financial documents. Access to these documents would allow the Agent(s) to review the tax information so that they may more accurately complete the taxpayer’s forms or competently represent them before a Department of Revenue.

Unless otherwise stated, by the taxpayer, this document shall revoke all other tax powers documents. This document may also be revoked at the discretion of the taxpayer.

How to Write

Step 1 – Download the Document –

- Should the Agent choose to request a document by fax, complete the information at the top of the page

- Review the remainder of this section

Step 2 – Effective Date – Enter:

- The date the document shall become effective

- UBI Number

- Name of authorizing business or Agent

- Agent name(s)

- Mailing address

- Telephone number

- Fax number

- Email address

- FEIN

- Check the box if address or phone number is new

Step 3 – Person, Company, Firm Authorized to Share Information – Submit:

- Name(s)

- Mailing address

- UBI/TIN/EIN

- Phone number

- Fax number

- Email address

- Check either box if applicable

Step 4 – Authorized Signature – Provide:

- Signature of the authorized signatory

Step 5 – Declaration and Signatures –

- Review the declaration

- Print taxpayer’s name

- Title

- Signature

- Date of signature in mm/dd/yyyy format

- City and State where signature is submitted

Step 6 – Copies –

- Make copies for taxpayer’s files

- Fax or mail to:

- Washington State Department of Revenue Taxpayer Services

- PO Box 47478

- Olympia, WA 98504-7478

- Fax: (360) 705-6733