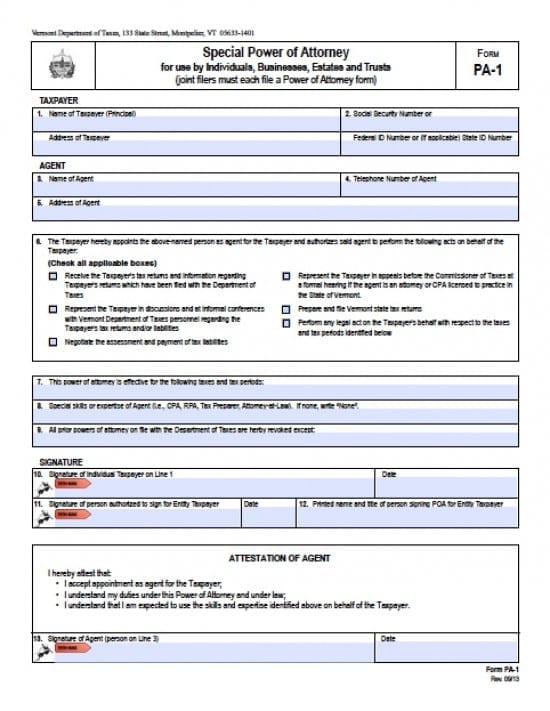

| Vermont Tax Power of Attorney Form |

The Vermont tax power of attorney form is a legal document that may be completed by a taxpayer to delegate powers to an individual or professional tax entity. The document may provide authorization to collect and review confidential, financial information so that the Agent(s) may competently complete the taxpayer’s tax documents. Authorization may also be granted for an Agent to sign documents on behalf of the taxpayer.

How to Write

Step 1 – Taxpayer Information – Enter the following:

- Name of Taxpayer (Principal)

- Social Security Number or

- Address of Taxpayer

- Federal ID Number or (if applicable) State Identification Number

Step 2 – Agent Appointment –

- Name of Agent

- Agent’s phone number

- Agent’s address

Step 3 – Authorization of Powers – Taxpayer must review the options:

- Select authorized powers by checking the preceding boxes

Step 4 – Tax Periods or Tax Years – Enter:

- Tax year or periods for which the document is effective

Step 5 – Agent’s Expertise –

- Submit the title of the Agent (if any)

Step 6 – Revocation of Previous Powers Documents –

- Enter any of the taxpayer’s previous powers documents that should remain in effect (if any)

Step 7 – Signatures – Submit the following information:

- Signature of individual taxpayer

- Date the signature in mm/dd/yyyy format

- Authorized agent or entity to provide taxpayer’s signature

- Date the agent’s signature in mm/dd/yyyy format

- Printed name and title of the person signing the form

Step 8 – Attestation of Agent –

- Agent must read and agree to the attestation

- Signature of Agent

- Date the signature in mm/dd/yyyy format