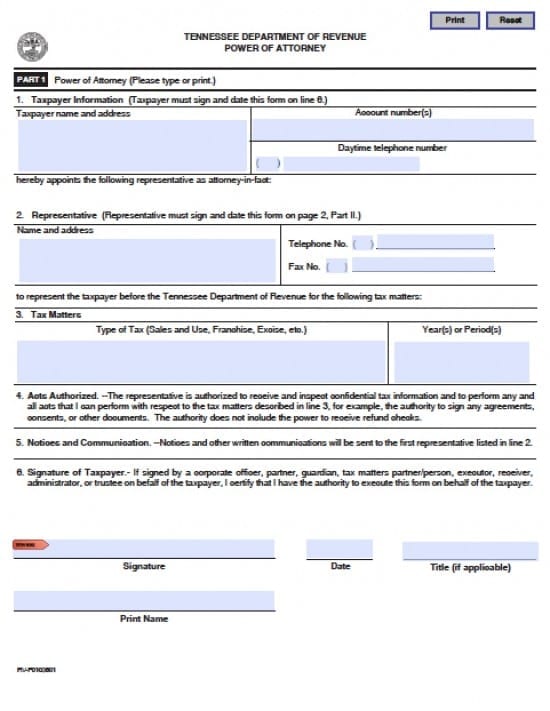

| Tennessee Tax Power of Attorney Form |

The Tennessee tax power of attorney form is a document that is made available to taxpayers so that they may assign an individual or a firm that employ’s tax professionals, as their Agent, so that the assigned Agent may request and access confidential financial information and even sign on behalf of the taxpayers if needed.

This completed document allows the Agent(s) the ability to complete all tax forms and review any information in the event the taxpayer(s) may require representation before any Department of Revenue. This document must be signed by all required parties, in the appropriate spaces, or it will be returned until corrected by the Department of Revenue

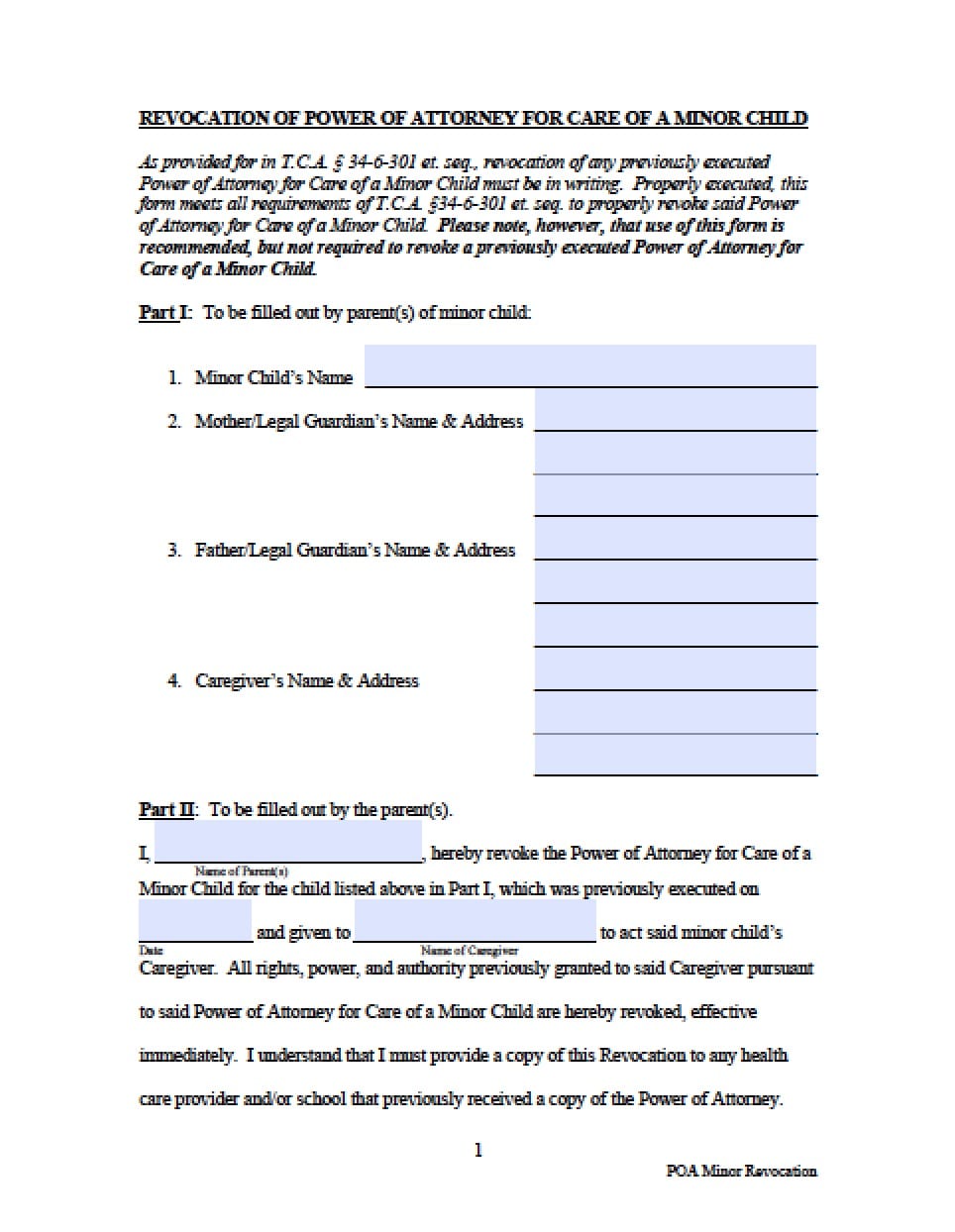

This document shall revoke all other tax powers document(s) unless otherwise stated in writing by the taxpayer(s). This document may also be revoked at any time that the Principal may find it appropriate.

How to Write

Step 1 – Taxpayer’s Information –

- Taxpayer name and address

- Account number(s)

- Daytime telephone number

Step 2 – Appointment of Agent(s) –

- Submit the name of the selected Agent

- Provide the name and address of the Agent

- Telephone number

- Fax number

Step 3 – Tax Matters – Enter:

- Type of Tax (Sales and Use, Franchise, Excise, etc.)

- Enter the Year(s) or Period(s) in review

Step 4 – Titled Sections – Taxpayers must read:

- Acts Authorized

- Notices and Communications

Step 5 – Taxpayer’s Signature –

- Submit the Taxpayer’s Signature in the line provided

- Print the taxpayer’s name

- Date the signature in mm/dd/yyyy format

- Enter a title (if any)

Step 6 – Declaration of Representative (Agent(s)) –

- All Agent(s) must read the declaration in this section before proceeding

- After reviewing the declaration, the Agent must complete the information required in the table provided as follows:

- Designation -Insert an appropriate letter (a-c)

- Jurisdiction (state)

- Signature

- Date the information in mm/dd/yyyy format

Step 7 – Mail the completed document to the following address:

Tennessee Department of Revenue

Andrew Jackson Office Building 500

Deaderick Street

Nashville, Tennessee 37242

All signatures must be in place or this document will be returned to the first Agent on the list