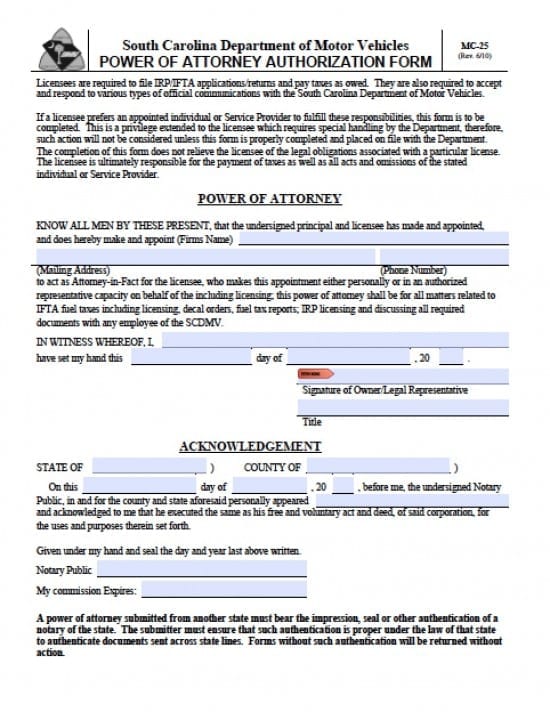

| South Carolina Vehicle Power of Attorney Form |

The South Carolina vehicle power of attorney form is a document that is provided by a Principal to appoint an Agent to perform various duties pertaining to IFTA fuel taxes including licensing, decal orders, fuel tax reports, IRP licensing and any discussion of all required documents with any employee of the SCDMV.

This document may be revoked at any time by the licensee. The document’s signatures, must be witness by a licensed Notary Public.

Step 1 – Appointment of Agent – Enter:

- The name of the firm

- The Firm’s mailing address

- Firm’s telephone number

Step 2 – Signatures –

- Enter the printed name of the authorized representative or owner

- Enter the date of the execution of the document in dd/mm/yy format

- Enter the signature of the owner or authorized representative

- Enter the title of the representative (if applicable)

Step 3 – Notarization –

Once the document is signed and witnessed by the Notary Public, the Notary will be required to complete the document with all of the state required information that shall acknowledge the validity of the document