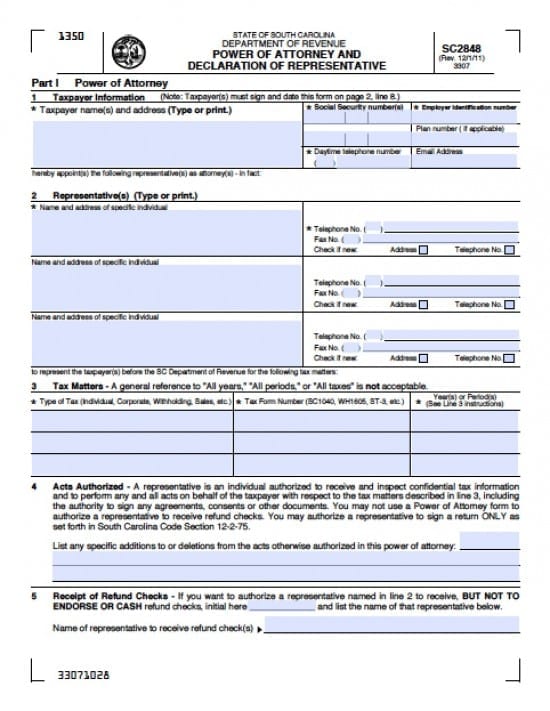

| South Carolina Tax Power of Attorney Form |

The South Carolina tax power of attorney form is a document that a taxpayer or taxpayers may provide to a business that employs any level of tax preparation service, a tax attorney, a tax firm or even an individual, so that they may legally acquire confidential financial information so that they may competently and accurately complete tax forms and/or represent the taxpayer(s) be for any Department of Revenue if required.

Completion of this document will revoke all other tax powers documents unless otherwise stated by the taxpayers. As well, this document may be revoked by the taxpayer(s) at any time.

How to Write

Step 1 – Taxpayer’s Information –

- Taxpayer name(s) and address (print or type only)

- Social Security number(s)

- Employer identification number

- Plan number ( if applicable)

- Daytime telephone number

- Email Address

Step 2 – Appointment of Agent(s) –

- Enter, individually, the name(s) and addresses of each appointed Agent

- Telephone Number

- Fax Number

- Check one of the boxes if applicable

Step 3 – Tax Matters – (Do not enter the words “All periods” or “All taxes” will not be acceptable and the form will be returned. Enter the following information into the columns provide in the table provided:

- Type of Tax (Individual, Corporate, Withholding, Sales, etc.)

- Tax Form Number (SC1040, WH1605, ST-3, etc.)

- Year(s) or Period(s)

Step 4 – Acts Authorized – Read the information in this section:

- Once the information has been reviewed, the taxpayers may list specific additions or deletions from the acts that would otherwise be authorized

Step 5 – Receipt of Refund Checks –

- Should the taxpayers choose not to allow receipt or endorsement or cash any refund checks, initial the line

- If the refund check is to be received, enter the name of the representative who shall have permission to receive the check(s)

Step 6 – Retention/Revocation of Prior Powers –

- If the taxpayers wish to keep all prior powers documents active, check the box

Step 7 – Signatures – All signatures must be applied or the forms shall be returned. Provide the Taxpayer(s) information as follows:

- Taxpayer’s Signatures

- Printed names

- Dates of the Signatures

- Title if Applicable

Step 8 – Notice and Communications –

- Taxpayers must review this section

Step 9 – Declaration of Agent(s) – The Agent(s) must read the declaration area. Once the review is complete, all participating Agent(s) must enter their information, into the table provided. If this information is not entered, the form shall be returned:

- Designation – Insert letter A through H

- Jurisdiction (state)

- Signature

- Date

The remaining pages of this document are information that the taxpayer may wish to refer to if needed. Print and/or copy the entire document and file it for record keeping.