| South Carolina Durable Financial Power of Attorney Form |

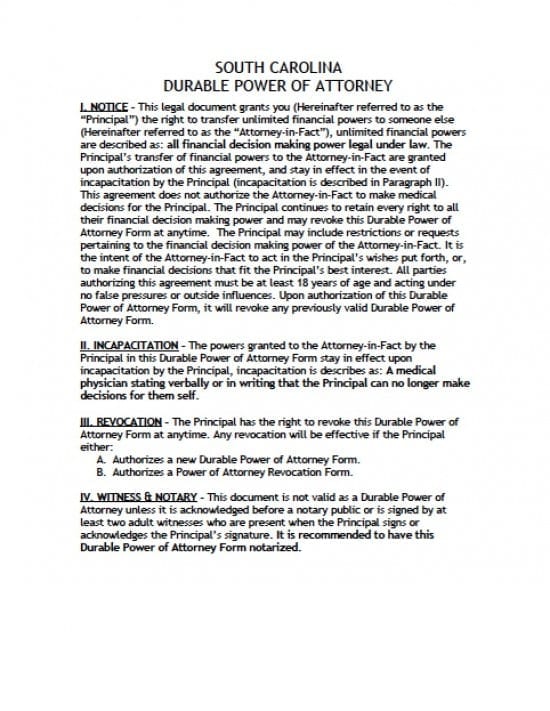

The South Carolina durable financial power of attorney form is a document that will permit a Principal the ability to assign and Agent to act on behalf of the Principal to perform specified powers. The powers will begin, (unless otherwise specified by the Principal) upon the execution of this document and will remain in effect even if the Principal becomes disabled or incapacitated, again, unless the Principal revokes the document. This document should be reviewed carefully by the Principal, before completion and application of signatures. If the Principal is unsure of any of the language contained within this document, they may wish to speak with an attorney for guidance.

This document must be signed before a notary and two (2) witnesses. This document may be revoked at any time by the Principal, in writing, and by delivery or service to the Agent, by the Principal

How to Write

Step 1 – Download the Document – Principal should review the following titles:

- Notice

- Incapacitation

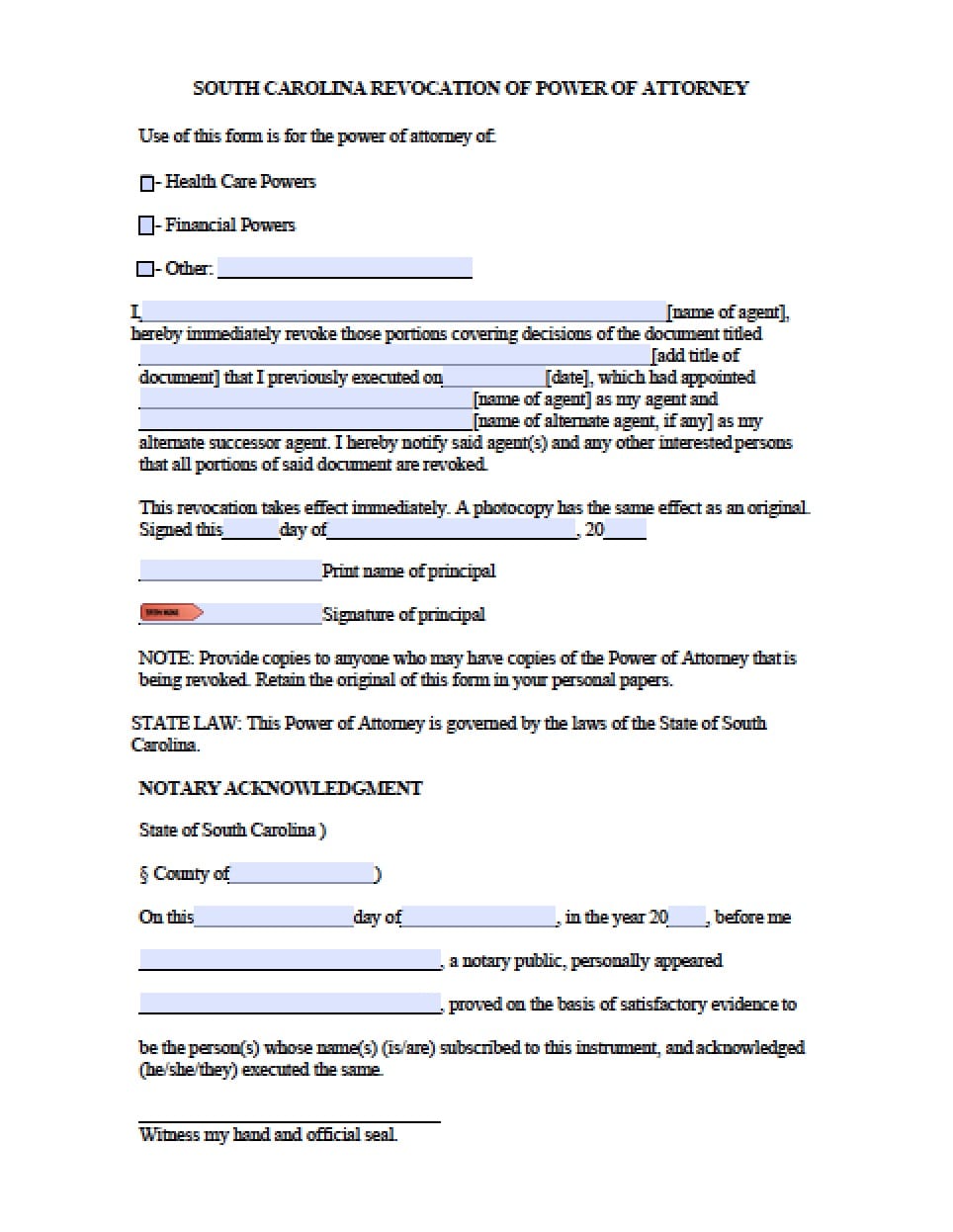

- Revocation

- Witness and Notary

Step 2 – The Parties – Provide all of the following information:

- Name of the Principal

- Street Address

- City

- State

- AND

- Name of the Agent

- Street Address

- City

- State

- Enter the state where the powers document shall be utilized

- AND

- Name of the Successor Agent (optional)

- Street Address

- City

- State

- Provide the state where the powers document shall be used

- The Principal must carefully read the Terms and Conditions

Step 3 – Granting of Powers – The Principal must review all of the powers. If the Principal should choose to grant any specific power, enter their initials, if they choose to reject any of the power,then place an “X” in the line instead – Review the following:

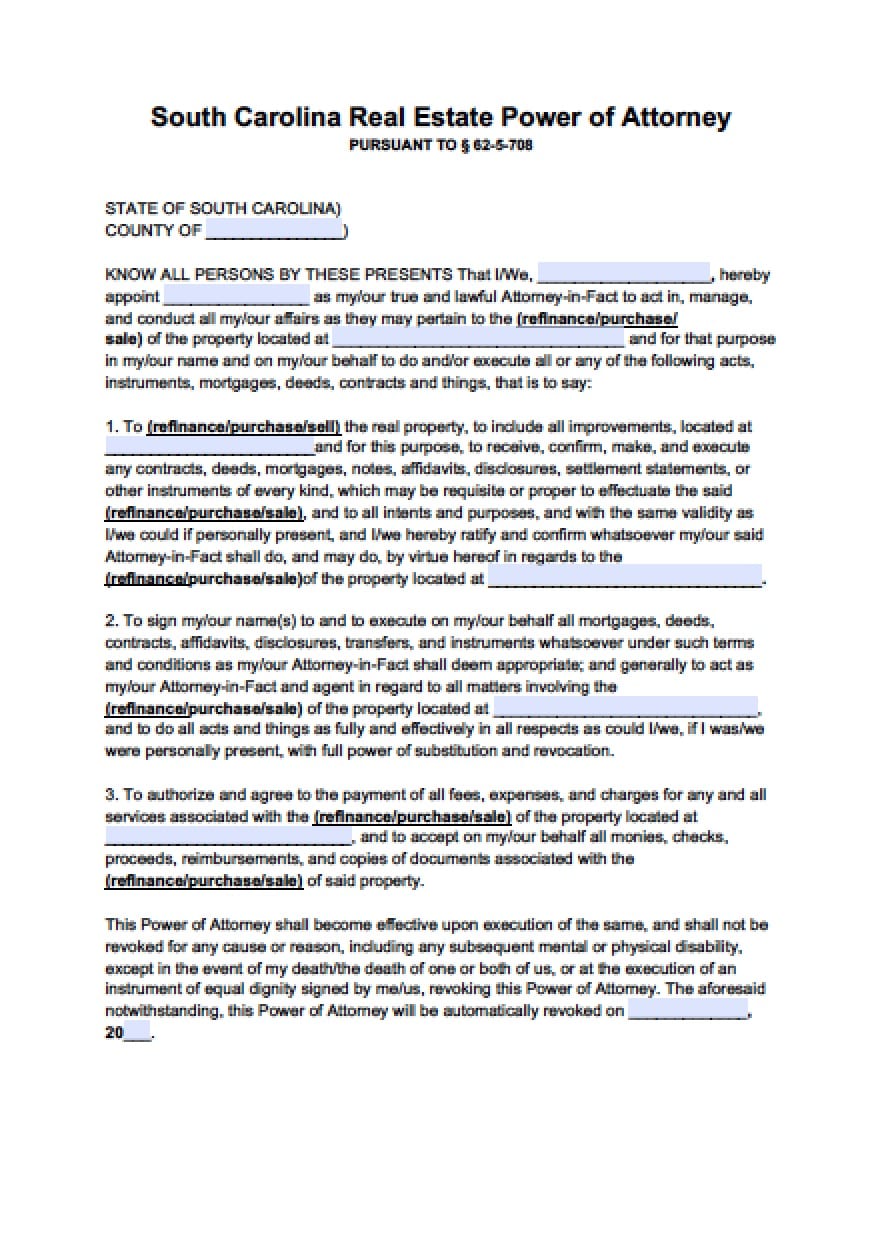

- (A) Real property transactions

- (B) Tangible personal property transactions

- (C) Stock and bond transactions

- (D) Commodity and option transactions

- (E) Banking and other financial institution transactions

- (F) Business operating transactions

- (G) Insurance and annuity transactions

- (H) Estate, trust, and other beneficiary transactions

- (I) Claims and litigation

- (J) Personal and family maintenance

- (K) Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- (L) Retirement plan transactions

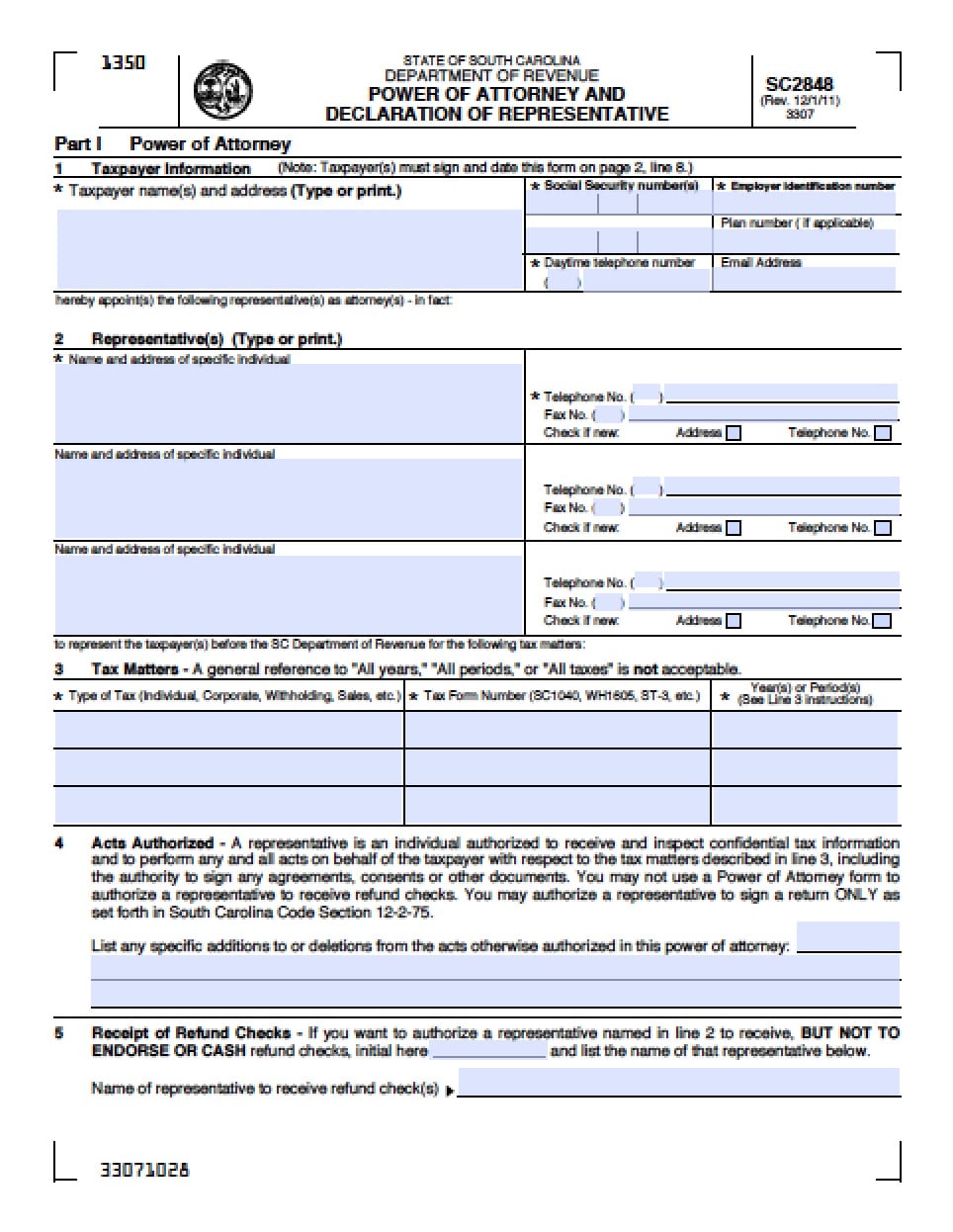

- (M) Tax matters

Step 4 – Additional Titles – The Principal must carefully review the following:

- Third Parties

- Compensation

- Disclosure

Step 5 – Signatures – Must be entered before a notary public, enter:

- Printed name of the Principal

- The Date the signature in dd/mm format

- The Principal’s Signature

- AND

- The printed name of the Agent

- The Agent’s Signature

- Date the signature in mm/dd/yyyy format

- AND

- Submit the printed name of the Successor Agent (optional)

- The Successor Agent’s signature

- Date the Successor’s signature in mm/dd/yyyy format

Step 6 – Notary Acknowledgement –

As the notary witnesses all signatures, the notary shall acknowledge the document by entering all of the information required to acknowledge the document and it’s validity

Step 7 – Acknowledgement and Acceptance of Appointment as Agent and Successor Agent –

- Each Agent must read their acceptance information, if they agree:

- Enter the name of each Agent in their respective paragraphs

- Provide signatures

- Date the signatures in mm/dd/yyyy format

Step 8 – Witness Attestation – The witnesses must read the attestation paragraph and enter:

- Both witnesses must enter their printed names

- Each witness must provide their signatures