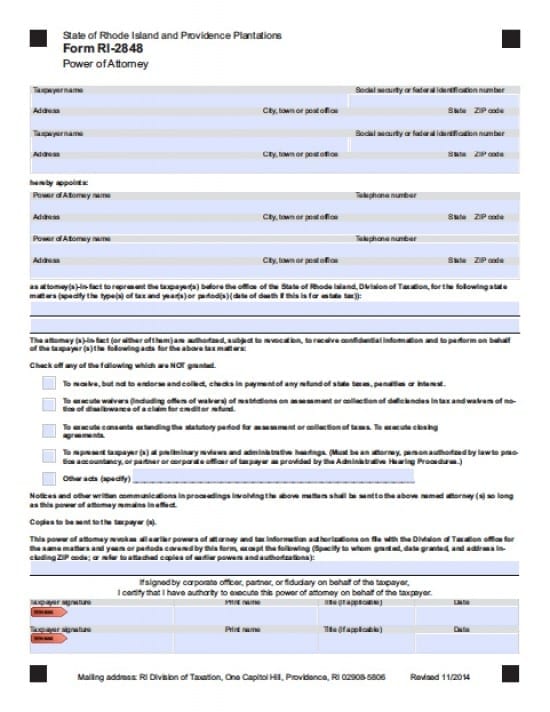

| Rhode Island Tax Power of Attorney Form |

The Rhode Island tax power of attorney form is a document that is provided by a taxpayer to allow an individual or business entity to acquire confidential, financial information for the purpose of accurately completing tax documents and/or providing representation before any tax agency. Completion of this document, unless otherwise stated in writing by the Principal, shall revoke automatically, all other tax powers documents.

This document may be revoked at any time the Principal at their discretion.

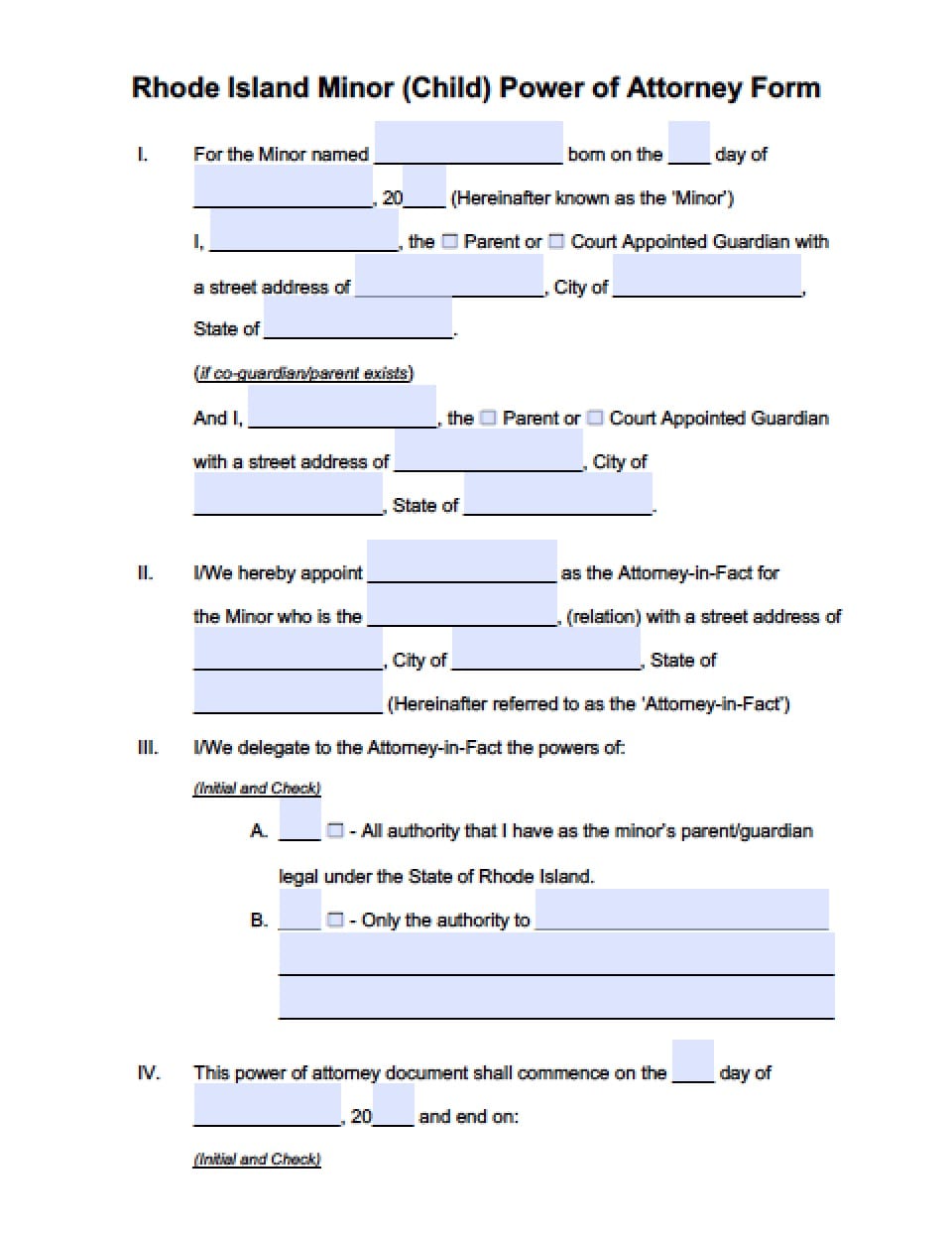

How to Write

1 – Locate The Form

You may download the form by clicking the PDF button and saving it.

2 – Taxpayer’s Information

The first table in this form will provide several rows to report the information for one or two Taxpayers. The individuals here will be considered Principal Taxpayers and will be granting authority over their matters to another party through the execution of this document. Each Principal Taxpayer will have two rows of information to supply:

- In the first row, report the Principal Taxpayer’s Name in the first cell and Social Security or Federal Identification number in the second cell

- Document the Principal Taxpayer’s Street Address, City/Town/Post Office, State, and Zip Code on the second row of the Principal Tax payer’s entry.

- If there is another Principal Taxpayer, report this information for that individual using the third and fourth rows, otherwise, you may leave them blank

2 – Agent Appointment(s)

The Power of Attorney being granted by the Principal Taxpayer through this document must go to an individual defined in this next area. Report the information for this individual in the table below the words “hereby appoints.” The table will accommodate up to two Agents (Attorney-in-Fact), at least one must be defined. Each party listed will have two rows which call for information:

- List the name of the Agent, under the words “Power of Attorney Name,” then next to this, in the first row of the entry, report his or her Phone Number

- In the second row of the entry, report the Address, City/Town/Post Office, State, and Zip Code where the Attorney-in-Fact is physically located

3 -Defining the Principal Authority Being Granted

Below the paragraph introduced by the words “as attorney(s)-in-fact to represent the taxpayer(s)…” will be two blank lines. These must bear a description of what the Agent may do with Principal Authority that is specific when dealing with the State of Rhode Island Division of Taxation in regard to:

- Type of tax documents the Agent may control

- Time period (mm/yyyy – mm/yyyy) in which the Agent has Principal Authority over

Locate the statement starting with “The attorney(s)-in-fact (or either of them) are authorized…” then review the statements in the check box list. Each check box defines types of actions the Agent may take on behalf of the Principal. Check any of the boxes indicating powers that will NOT be granted by the Taxpayer(s). If there are other acts not defined, that must be controlled, place a mark in the check box labeled “Other” then, provide the instructions, conditions, terms, or provisions that must be applied.

4 -Signature of Taxpayer Consent

The Taxpayer(s) Must Read the Following Paragraphs and take the following actions:

- Notices

- Copies

- Revocation Information

- If there are powers documents that the taxpayers choose to remain in effect, list them on the line provided and provide copies of the powers to remain in tact

- If this section is signed by a corporate officer, partner, or fiduciary on behalf of the taxpayer, the Agent certifies that they have authority to execute this power of attorney on behalf of the taxpayer. The Agents must enter the following:

- Each Principal Taxpayer must sign his or her name under the words “Taxpayer signature,” print his or her name under the words “Print name,” report any applicable Title he or she holds under the word “Title,” and record the Date of the Signature under the word “Date”

5 – Declaration of Attorney-In-Fact

The Attorney-in-Fact should read the Declaration Statement, then satisfy the information requirements of this section:

- The Attorney-in-Fact should place a mark in the check box next to the statement that best describes his or her role.and check the applicable box

- Each Attorney-in-Fact must use a row in the table to report his or her Designation (i.e. Attorney, CPA) and Jurisdiction (i.e. Rhode Island) then, provide his or her Signature and Date of Signature

6- Additional Parties Present

The next area will provide a choice to verify the authenticity of this document. Choose one of these then have the additional party provide the required items:

- If this signing is being viewed by Witnesses, check the first box then have each Witness provide a Signature and Signature Date

- Check the second box if this signing occurs in the presence of a notary, then have the notary provide his or her Credentials, Seal, and Date