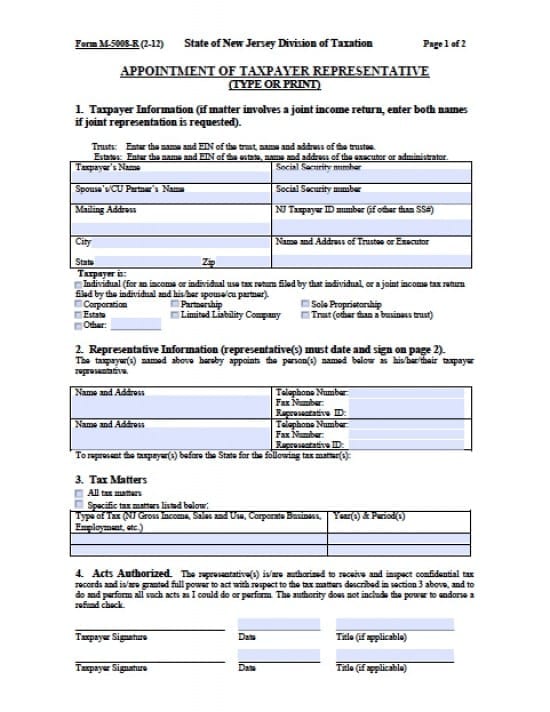

| New Jersey Tax Power of Attorney Form |

The New Jersey tax power of attorney form is a document whereas the taxpayer(s) may grant powers to an individual or business, as Agent(s), that specializes in tax preparation and representation before any revenue service. The document will ask that the taxpayers provide permission to receive and review confidential information so that the completion of tax documents may be completed with accuracy.

This document may be revoked by the taxpayer(s) at their discretion.

How to Write

Step 1 – Taxpayer Information – Provide the following:

- Taxpayer’s Name(s)

- Social Security number

- Spouse’s/CU Partner’s Name

- Social Security number

- Mailing Address

- NJ Taxpayer ID number (if other than SS number)

- City, State, Zip

- Name and Address of Trustee or Executor

Step 2 – Taxpayer is – Check the applicable box:

- Individual (for an income or individual use tax return filed by that individual, or a joint income tax return filed by the individual and his/her spouse/cu partner)

- Corporation

- Partnership

- Sole Proprietorship

- Estate

- Limited Liability Company

- Trust (other than a business trust)

- Other – Enter any other Title that isn’t listed

Step 3 – Agent(s) Information – Submit the following for each Agent:

- Name and Address

- Telephone Number

- Fax Number

- Representative ID

Step 4 – Tax Matters – Check box, then enter the following:

- All tax matters

- Specific tax matters listed below

Enter into the table provided:

- Type of Tax (NJ Gross Income, Sales and Use, Corporate Business, Employment, etc.)

- AND

- Year(s) & Period(s)

Step 5 – Acts Authorized – Submit the taxpayers signatures:

- Taxpayer Signature(s)

- Date

- Title (if applicable)

Step 6 – Form M-5008—R (2-12) – Enter the following:

- Taxpayer Name

- Social Security Number

Step 7 – Notices and Communications – Check one of the following boxes as it applies (on the document):

- I do not want any notices or communications sent to my representative(s)

- The second representative listed in section 2 should also receive a copy of notices and/or communications (other than automated computer notices)

Step 8 – Retention/Revocation of Prior Appointment(s) or Power(s) –

- Check this box if you do not wish to revoke any previous powers documents

Step 9 – Signature of Taxpayer(s) –

- “If a tax matter concerns a joint return, both primary and spouse/cu partner must sign below if joint representation is requested. If signed by a corporate officer, partner, guardian, tax matters partner, executor, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer(s)”

- This appointment of the Agent(s) will not be valid if signatures are not present

- Taxpayer Signature

- Date of signature(s) in mm/dd/yyyy

- Title (if applicable)

- Printed Name(s) of Taxpayers

Step 10 – Acceptance of Agent(s) and Sample Signatures – Agent(s) must read the statement, if in agreement provide the following:

- Agent(s) Signature(s)

- Date of Signature(s)

- Title (if applicable)

- Printed Name(s)