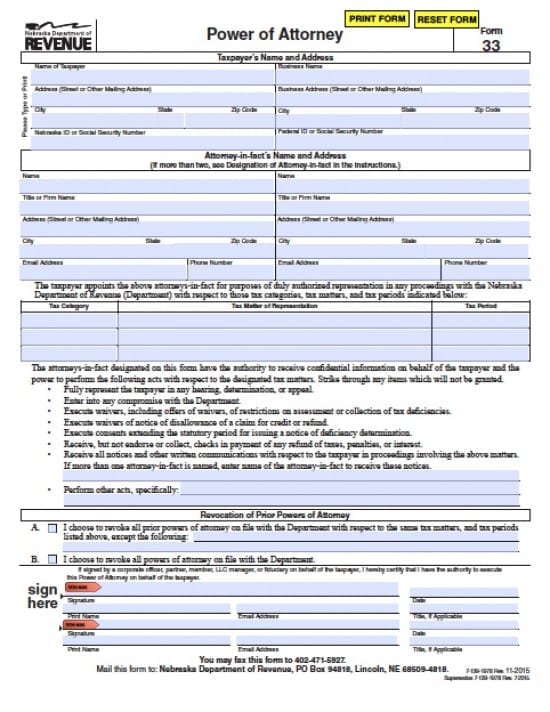

| Nebraska Tax Power of Attorney Form |

The Nebraska tax power of attorney form is a document that is required should taxpayer(s) choose to provide permission for an individual or business entity to acquire access to confidential documents belonging to the taxpayer(s) as well it will grant powers to an individual or business entity to legally have the ability to complete the tax documents and, if required, represent the taxpayer before any tax agency.

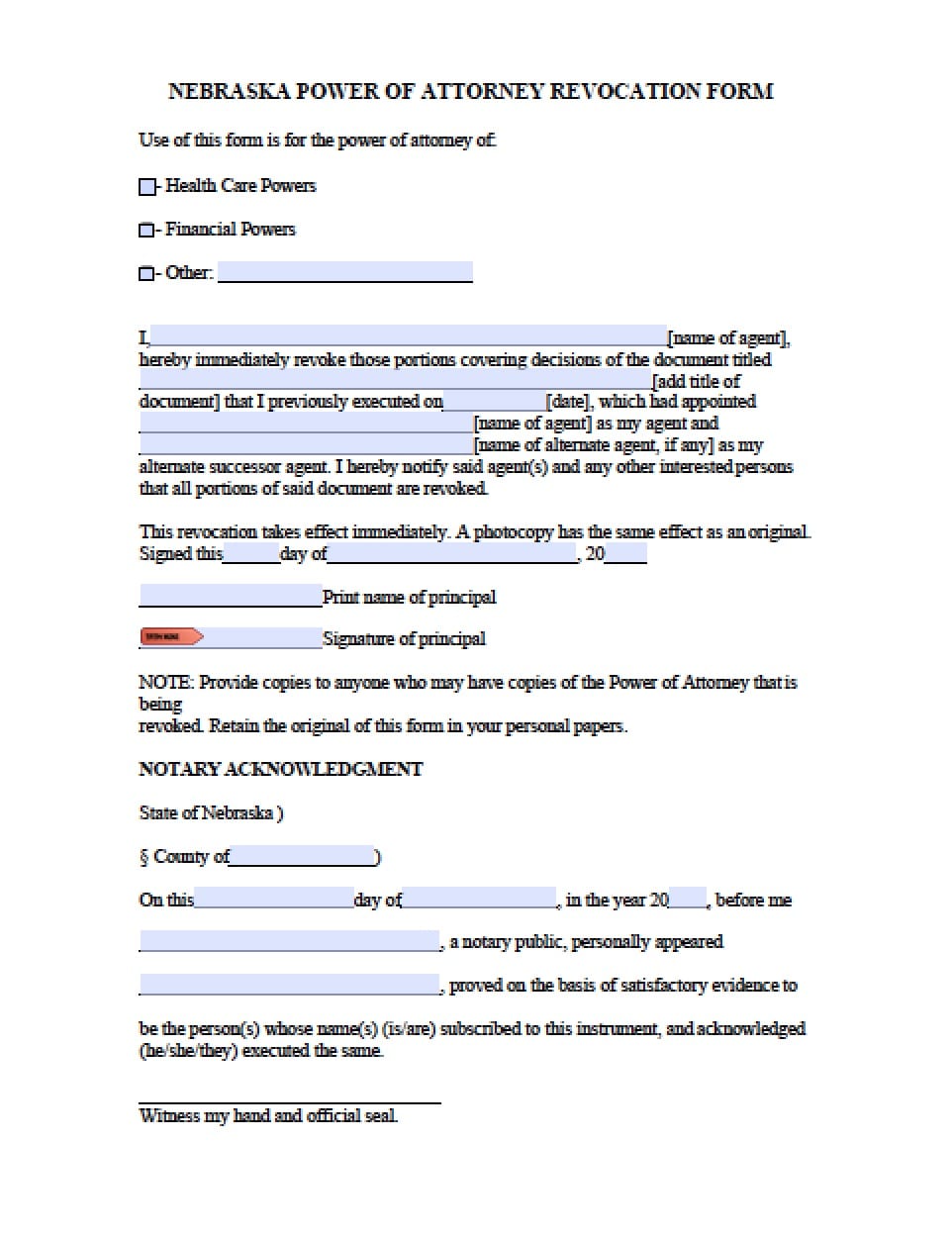

Completion of this document will revoke all previous powers documents unless otherwise stated in writing by the taxpayer. As well this document may be revoked by the taxpayer if they choose to do so.

How to Write

Step 1 – Taxpayer Information – Enter the following information:

- Name of Taxpayer

- Address (Street or Other Mailing Address)

- City

- Nebraska ID or Social Security Number

- City,State, Zip Code

If the taxpayer is a business provide the following:

- Business Name

- Business Address

- City,State, Zip Code

- Federal ID or Social Security Number

Step 2 – Agent’s Information – Enter the following information per Agent:

- Name

- Title or Firm Name

- City, State, Zip Code

- Email Address

- Phone Number

- Email Address

Step 3 – Tax Matters, Year(s) and Period(s) – In the table provided, enter the required information as follows:

- Tax Category

- Tax Matter of Representation

- Tax Period

Step 4 – Powers to be Granted by the Taxpayer – Review the following powers – If the taxpayer sees powers they choose not to grant, simply strike through the statement. The remaining statements shall apply as valid powers to the Agent(s):

- Fully represent the taxpayer in any hearing determination or appeal

- Enter into any compromise with the Department

- Execute waivers, including offers of waivers, of restrictions on assessment or collection of tax deficiencies.

- Execute waivers of notice of dis-allowance of a claim for credit or refund

- Execute consents extending the statutory period for issuing a notice of deficiency determination

- Receive, but not endorse or collect, checks in payment of any refund of taxes, penalties, or interest

- Receive all notices and other written communications with respect to the taxpayer in proceedings involving the above matters. If more than one attorney-in-fact is named, enter name of the attorney-in-fact to receive these notices – Enter all names of Agents to receive notices

- Perform other acts, specifically – Enter any specific acts the taxpayer would like to specify, in the line provided on the form

Step 5 – Revocation of Prior Powers –

- The taxpayer must review both statements (A and B)

- If A is selected and there are exceptions, enter them into the line provided

Step 6 – Signature (s) -The taxpayer must enter their information – If the document will be signed on behalf of the taxpayer by someone else, their information must also be provided:

- Signature(s)

- Date of Signature in mm/dd/yyyy format

- Printed name(s)

- Email address(s)

- Title(s) if applicable