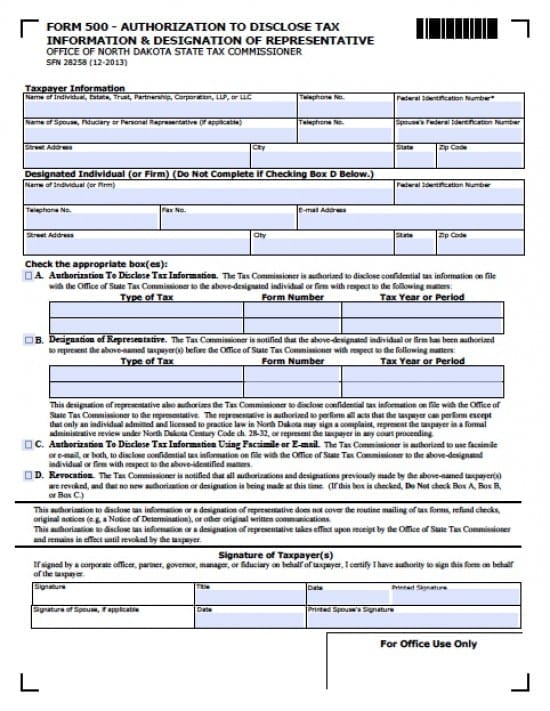

| North Dakota Tax Power of Attorney Form |

The North Dakota tax power of attorney form is a form that allows a taxpayer to designate an individual, tax attorney or a business that employs tax professionals, as their Agent. The document also provides authorization for the Agent(s) to access confidential financial information so that the Agent(s) may competently complete tax forms and/or represent the taxpayer(s) before any Department of Revenue. This document must be signed by all parties to ensure that the form is not returned. Completion of this document, unless otherwise stated in writing by the taxpayer(s) will revoke all other powers forms.

This document may also be revoked at any time, with a written notice of revocation, delivered to the Agent(s)

How to Write

Step 1 – Taxpayer Information – Complete the following:

- Name of Individual, Estate, Trust, Partnership, Corporation, LLP, or LLC

- Telephone Number

- Federal Identification Number

- Name of Spouse, Fiduciary or Personal Representative (if applicable)

- Telephone Number

- Spouses Federal Identification Number

- Street Address

- City

- State

- Zip Code

Step 2 – Designated Individual or Firm – Enter:

- Name of Individual (or Firm)

- Federal Identification Number

- Telephone Number

- Fax Number

- Email Address

- Street Address

- City

- State

- Zip Code

Step 3 – Authorization to Disclose Tax Information AND Designation of Representative (Agent(s) –

Check the appropriate boxes and complete the required information in the tables located next to any of the the checked box(es) as follows:

- Type of Tax

- Form Number

- Tax Year(s) or Period(s)

- The Principal must read all of the additional information very carefully, prior to completing each section or checking any boxes.

Step 4 – Signature of Taxpayer(s) or Agent with permission to sign on behalf of the taxpayer(s) – Submit the required information in the table:

- Signature

- Title

- Date of Signature in mm/dd/yyyy format

- Printed Name

- AND

- Signature of Spouse (if any)

- Type of Tax Form Number Tax Year or Period

- Printed Name of Spouse