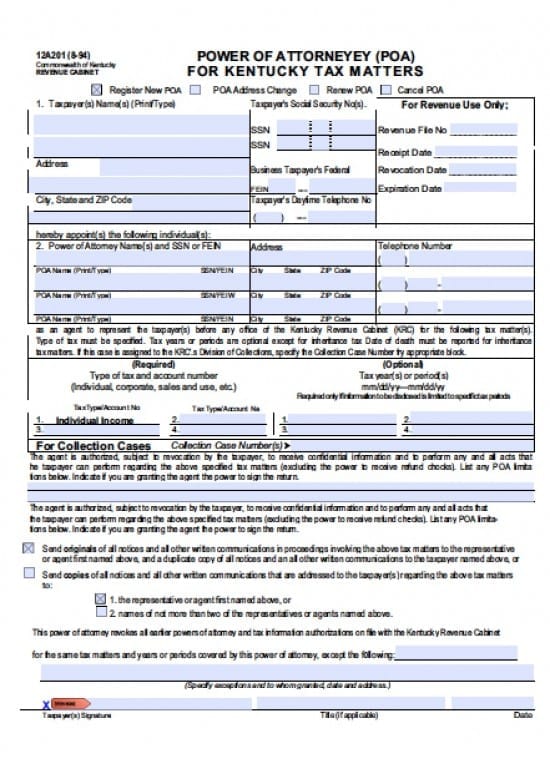

| Kentucky Tax Power of Attorney Form |

The Kentucky tax power of attorney form is a legal document that a taxpayer uses to provide powers to a business entity or an individual that would complete tax forms or represent a the client before a tax agency. This document will provide taxpayer(s) information. The client must be aware that the Agent will need to gather confidential tax and financial information so that they may properly and confidently prepare their tax documents and/or represent the Principal/Client. The agent will not be able to collect tax refund checks

This document will only be in force as until the act(s) are completed. This document may be revoked at any time by the Principal.

How to Write

Step 1 – Download the document – Begin by selecting one of the following:

- Register New POA

- POA Address Change

- Renew POA

- Cancel POA – (revocation)

Step 2 – Taxpayer(s) Information –

- Taxpayer(s) Name(s) (Print/Type)

- Address

- City, State and Zip Code

- Taxpayer’s Social Security Numbers(s)

- Business Taxpayer’s Federal FEIN Number

- Taxpayer’s Daytime Telephone Number

Enter the following Agents Names – (If more names are required, add a sheet with all of the same following information as follows:

- Name(s) of the Agents

- Physical Address (complete)

- City, State, Zip Code

- Telephone Number (include area code)

Step 3 – Type of Tax, Account Number and Tax Years – Information – Enter the information required for each taxpayer:

- Tax Type/Account Number

- Tax Year(s) or Period(s) from mm/dd/yyyy to mm/dd/yyyy

- For Collection Cases – Enter the collection case numbers

Step 3 – Agent Limitations –

- If the Principal wishes to impose any specific limitations, type or write them into the lines provided

- Indicate also, whether the Principal will be granted permission for the Agent(s) to sign documents on behalf of the Principal

Step 4 – Select Applicable Boxes – If the Principal would like all originals sent to the agent, they must be sent to the first agent on the list.

- Check the box that would best indicate the taxpayer’s preferences with regard to where original notices must be sent.

Step 5 – Revocations of Previous Documents – If the Principal has other powers document that they would like to revoke:

- The Principal will only need to type or write in the exceptions, stating only the powers that will not be revoked

Step 6 – Signatures – Provide the following:

- Taxpayer’s Signatures

- Title (if any)

- Date the signatures in mm/dd/yyyy format