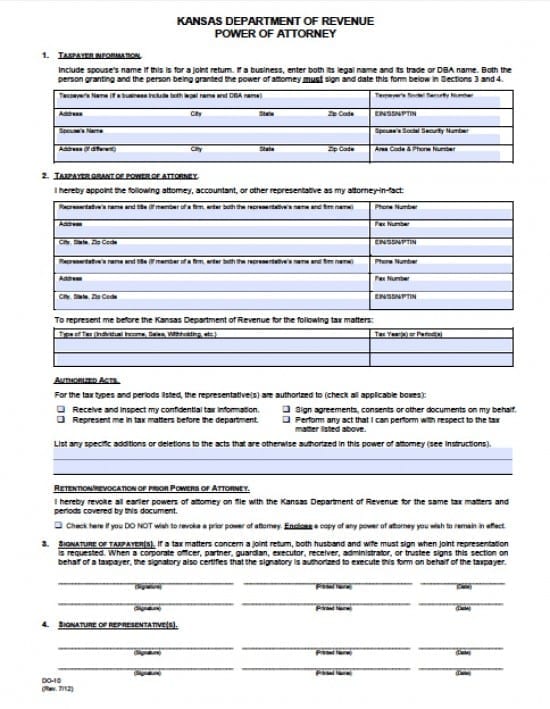

| Kansas Tax Power of Attorney Form |

The Kansas tax power of attorney form is a document that a Principal may use to assign powers to gather personal, confidential, financial information for the purpose of completion of tax forms and/or representing the Principal before a tax agency. The Principal must complete the document and provide the document to an individual or business who will take over the temporary powers.

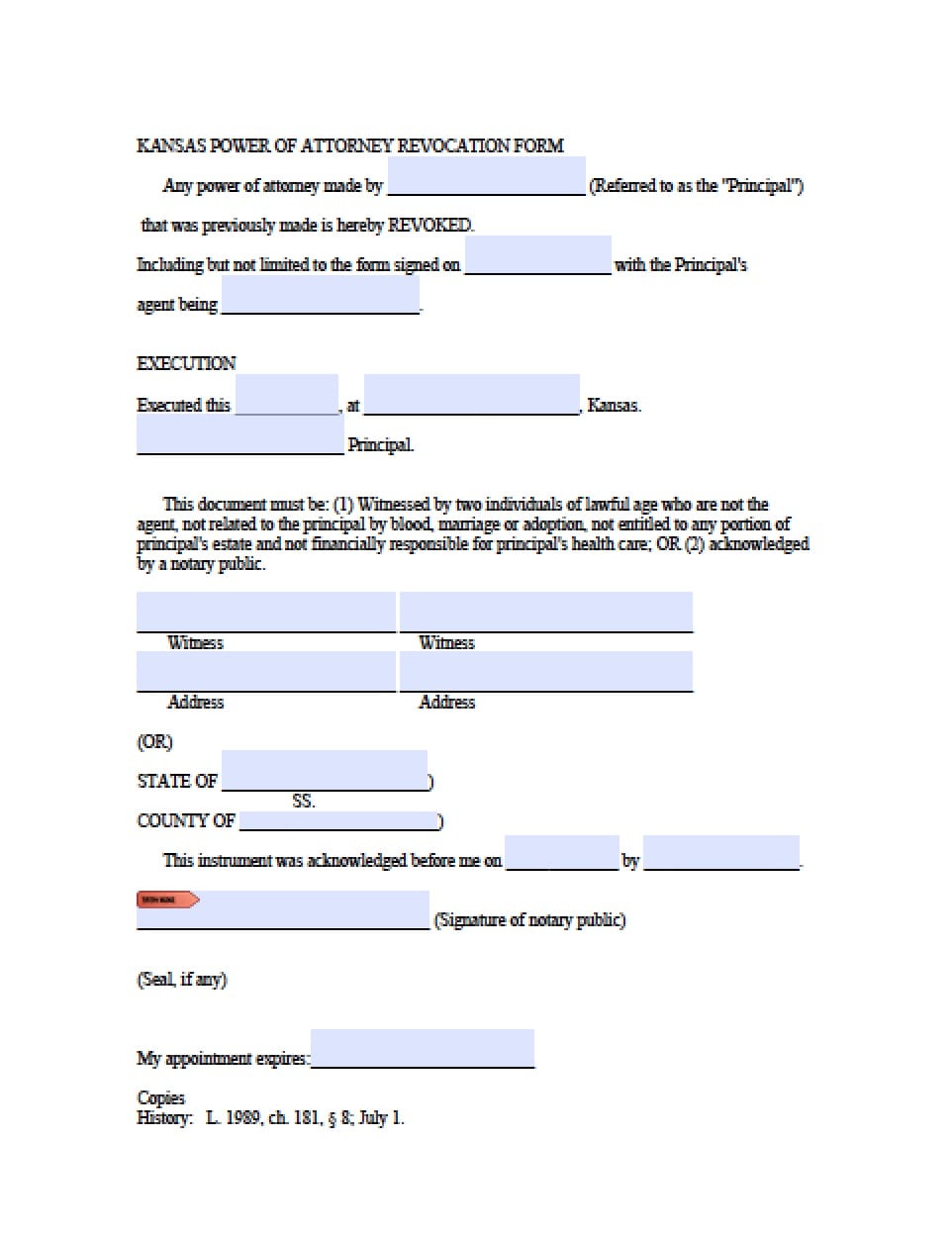

This document may be revoked at the discretion of the Principal. Notarization will not be required unless otherwise desired by the parties. All taxpayers must sign and date the form.

How to Write

Step 1 – Taxpayer’s Information: Enter the following:

- Taxpayer’s Name (if a business include both legal name and DBA name)

- Taxpayer’s Social Security Number (SSN)

- Street Address, City, State, Zip Code,

- Employee Identification Number (EIN)/Social Security Number (SSN) or PTIN

- Spouse’s Name

- Spouse’s Social Security Number

- Address (if different),City, State, Zip Code

- Area Code & Telephone Number

Step 2 – Taxpayer Grant of powers – If more than three (2) representatives must be assigned, enter them on an additional blank sheet and attach with all of the same information, per individual Agent, as shown:

- Representative’s name and title (if member of a firm, enter both the representative’s name and firm name)

- Address City, State, Zip Code

- Phone Number

- Fax Number

- EIN/SSN/PTIN

Step 3 – Type of Tax- Enter the required information as follows:

- Type of Tax (Individual Income, Sales, Withholding, etc.)

- Tax Year(s) or Period(s)

Step 4 – Authorized Acts – Enter the acts that the Principal wishes to grant to their Agent (check any or all of the following that would apply)

- Receive and inspect my confidential tax information

- Sign agreements, consents or other documents on my behalf

- Represent me in tax matters before the department

- Perform any act that I can perform with respect to the tax matter listed above

- List specific additions and/or deletions into the lines provided

Step 5 – Retention or Revocation of Prior Powers: Enter any revocations on file with the state of Kansas Department of Revenue:

- Check the box if the Principal chooses not to revoke previous powers

- If any previous powers will be deleted, provide and attach a copy of the document to be revoked

Step 6 – Signatures – Signatories must sign the documents whether it’s the Principals or representatives with powers to provide signature on behalf of the Principal(s)

- Enter the signature(s) of the Principal(s)

- Enter the Printed Names of the Principal(s)

- Date the signature(s) in mm/dd/yyyy format

Step 7 – Signatures of Representatives – If there are more than two(2) representatives that are entered on a separate sheet, be certain the added representatives also sign their information as follows:

- Representative’s Signature

- Printed Name

- Date each entered signature in mm/dd/yyyy format

The second sheet of the document is instructions provided by the tax department. Print the sheet and refer to it if necessary. As well print the primary document and retain a copy for record keeping purposes