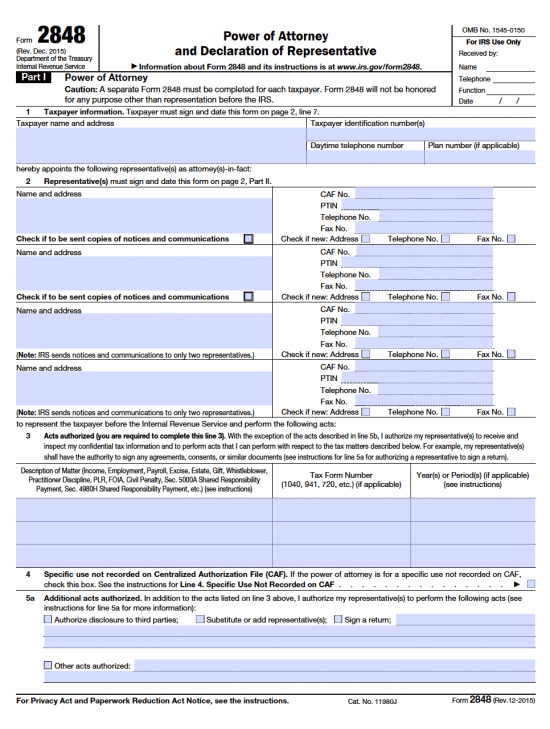

| IRS Power of Attorney | Form 2848 | Year 2016 |

IRS power of attorney, also known as Form 2848, is a form provided by the Internal Revenue Service for filers who wish to elect someone else to process their federal tax filing. This person is most likely an accountant or attorney but may be any one who is credible on behalf of the principal to handle their taxes. It should be attached to any filing sent to the IRS for submission. All parties must provide signatures to this document or it will be returned.

Instructions – Use this guide provided by the IRS to fill-in this form.

How to Write

Step 1 – Taxpayer Information – Enter:

- Taxpayer’s name and address

- Taxpayer’s Identification Numbers

- Daytime telephone number

- Plan number if applicable

Step 2 – Agent’s Information –

- Names and addresses (respectively)

- Check the box if communications are to be received by the Agent

- CAF number

- PITN

- Telephone number

- Fax number

- Check the box if the telephone number, address or fax number are new

Step 3 – Tax Matters – Submit the following information:

- Tax matters

- Tax form numbers (if any)

- Years or Periods

- Check the box if the powers document is for a specific use, not recorded on CAF

Step 4 – Additional Acts –

- Enter any additional, authorized acts, not already specified

- Check the applicable box

Step 5 – Other Acts Authorized –

- Enter any other acts the taxpayer wishes to authorize in the lines provided

Step 6 – Unauthorized Acts –

- The taxpayer must check the box and submit any powers that they choose not to grant to the Agent

- Should the taxpayer choose to allow other tax powers documents to remain effective, check the box and attach copies to this document

Step 7 – Taxpayer’s Signature – Submit the following:

- Taxpayer’s signature

- Date the signature in mm/dd/yyyy format

- Title (if any)

- Printed name

- OR

- Printed name of taxpayer on line one if necessary

Step 8 – Declaration of Agent – The Agent must review the entire declaration and enter into the table provided:

- Designation – Insert one letter as it applied (A through R)

- Licensing jurisdiction (State) or other licensing authority (if it applies)

- Bar, license, certification, registration, or enrollment number, should any of these apply

- Signature of each Agent

- Date the signatures in mm/dd/yyyy format