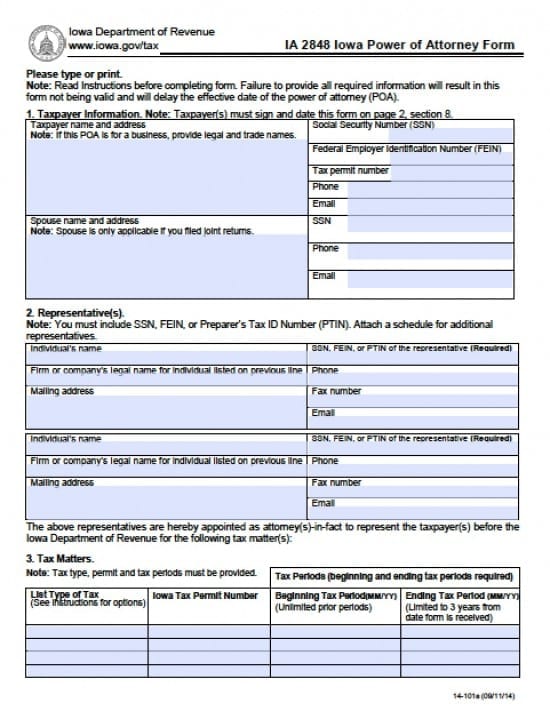

| Iowa Tax Power of Attorney Form |

The Iowa tax power of attorney form is a document that will allow a Principal to grant temporary powers to an individual or business, to acquire private financial information for or from, the Principal and complete as well as provide representation for the Principal before Tax agencies. All of the required information in this form must be complete or the document will be considered invalid and shall delay the ability for the Agent(s) to move forward with the Principal’s business.

This document will contain a date of termination, after the act has been completed, however, the document may be revoked at any time that the Principal deems necessary (if prior to the date entered on the form).

How to Write

Step 1 – Taxpayer Information – Enter the following:

- Taxpayer’s Name and Address (If this form is being completed on behalf of a business as the Principal enter the business, legal and/or trade names

- Spouse’s Name and Address (applies only if joint returns are filed)

- Social Security Number (SSN)

- Federal Employer Identification Number (FEIN)

- Tax permit number

- Phone Number

- Email Address

- AND

- Spouse’s Social Security Number

- Telephone Number

- Email Address

Step 2 – Representatives – If more room is needed to add more Agent’s, add their information on a separate sheet to include all Social Security Numbers, FEIN number, Tax Identification (PTIN) required – Enter all of the following information, per Agent, receiving powers:

- Agent’s Name

- Social Security Number (SSN), Federal Employer Identification Number (FEIN), or PTIN of the representative (Required)

- Firm or company’s legal name for individual listed on previous line

- Phone

- Mailing Address

- Fax Number

- Email Address

Step 3 – Tax Matters – Provide the following information: (Required will be the entrance of the beginning and ending tax periods)

- List Type of Tax

- Iowa Tax Permit Number

- Beginning Tax Period in mm/yyyy format

- Ending Tax Period in mm/yyyy format (limited to a 3 year time frame, from the date the form is received)

Step 4 – Acts Authorized – This section enables the Agent to work with the Principal’s private information as required by granting of permission from the Principal)

- The Principal must carefully review this information making additions and/or deletions on the lines provided

Receipt of Refund Checks –

- Should the Principal wish to authorize refunds to be delivered to the Agent(s), the Principal must provide their initials. The Agent(s) will not be authorized to endorse or cash any checks

Notices and Communications –

- Notices will be sent to the Principal and the first Agent listed

Retention and Revocation –

- This document will automatically revoke any other powers documents. If the Principal does not want to revoke previous powers documents, check the box provided. The Principal/Agent(s) must attach a copy of any other powers document that shall remain in effect

Step 5 – Signature(s) of Taxpayer(s) – Any taxpayers named on this document must provide the following:

- Signature

- Date of the signature

- Print the name of the taxpayer(s)

- Title

Step 6 – Agent(s) must mail all completed documents and required information to:

- Registration Services

- Iowa Department of Revenue

- PO Box 10470

- Des Moines IA 50306-0470

- OR

- Fax to: 515-281-3906

An instruction page is available at the end of these documents, should the Agent(s) and/or Principal choose to refer to it for any sort of clarification.