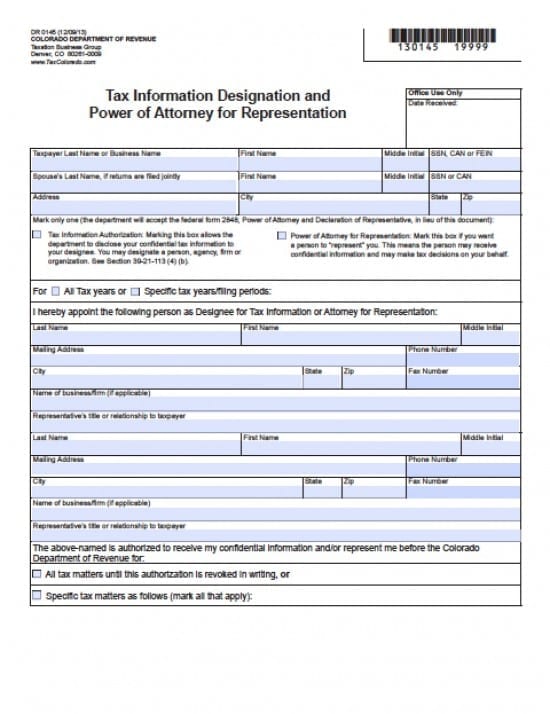

| Colorado Tax Power of Attorney Form |

The Colorado tax power of attorney form is a legal document which allows the designated party (Attorney in Fact/Agent) to discuss all aspects of the tax account for the period specified on the document. The federal power of attorney form 2848 is accepted by the Colorado Department of Revenue in lieu of the Colorado DR 0145 form. Your agent must act in good faith on your behalf, however, the principal should closely review the information with the agent(s) inasmuch as the principal will always be responsible for discrepancies. If you’re working with a firm, be certain to ask about their policies with regard to defense in the event of any mistakes made with their firm. Be sure the tax type and period is noted on the form. (See §39-21-112, C.R.S)

How To Write

Step 1 – Tax Information Designation and Power of Attorney for Representation – Principal must provide the following taxpayer’s information:

- Taxpayer Last Name or Business Name First Name

- Middle Initial

- SSN, CAN or FEIN

- Spouse’s Last Name, if returns are filed jointly

- First Name

- Middle Initial

- SSN or CAN

- Physical or Business Address

- City

- State

- Zip Code

Step 2 – Mark only one of the selections in the next box as follows:

- “Tax Information Authorization: Marking this box allows the department to disclose your confidential tax information to your designee. You may designate a person, agency, firm or organization. See Section 39-21-113 (4) (b)”

- OR

- “Power of Attorney for Representation: Mark this box if you want a person to “represent” you. This means the person may receive confidential information and may make tax decisions on your behalf.”

Step 3 – Tax Years Filing – Mark one of the following options:

- All Tax years

- OR

- Specific tax years/filing periods -(If this is your selection, provide all dates to be included)

Step 4 – Appointment of designee or attorney – There are two blocks provided, if there will be more than one designee, add their same information of a separate sheet to attach to this form – Provide the following both/all

- Designee Information –

- Last Name

- First Name

- Middle Initial

- Mailing Address

- Phone Number

- City

- State

- Zip

- Fax Number

- Name of business/firm (if applicable)

- Representative’s title or relationship to taxpayer

Step 5 – Selection of Designee duties – The above-named is the person with whom you’ve authorized to receive your confidential information and/or to represent me before the Colorado Department of Revenue in your following selected capacity:

- “All tax matters until this authorization is revoked in writing”

- OR

- “Specific tax matters as follows (mark all that apply in the boxes following this statement on the form as follows:

- State Sales Tax Period (MM/DD/YY-MM/DD/YY)

- Partnership Income Tax Period (MM/DD/YY-MM/DD/YY)

- State Consumer Use Tax Period (MM/DD/YY-MM/DD/YY)

- Withholding Income Tax Period (MM/DD/YY-MM/DD/YY)

- Individual Income Tax Period (MM/DD/YY-MM/DD/YY)

- All Department- Administered Sales Taxes Period (MM/DD/YY-MM/DD/YY)

- Corporate Income Tax Period (MM/DD/YY-MM/DD/YY)

- All Department- Administered Consumer Use Taxes Period (MM/DD/YY-MM/DD/YY)

- Fiduciary Income Tax Period (MM/DD/YY-MM/DD/YY)

- Other tax (specify) Period (MM/DD/YY-MM/DD/YY) – place any other information in the line provided. If more room is required, add a sheet with explanation and attach to this form.

Step 6 – Signature(s) – Read all of the information contained in the “Signature(s) of Taxpayer(s)” box and then provide the following information on the form:

- Signature

- Print Name

- Date of signature (MM/DD/YY)

- Title (if applicable)

- Daytime telephone number

- Spouse Signature (if joint representation)

- Print Name

- Date of signature (MM/DD/YY)

Step 7 – Signature of Declared Representative – provide:

- Signature

- Date (MM/DD/YY)

- Title

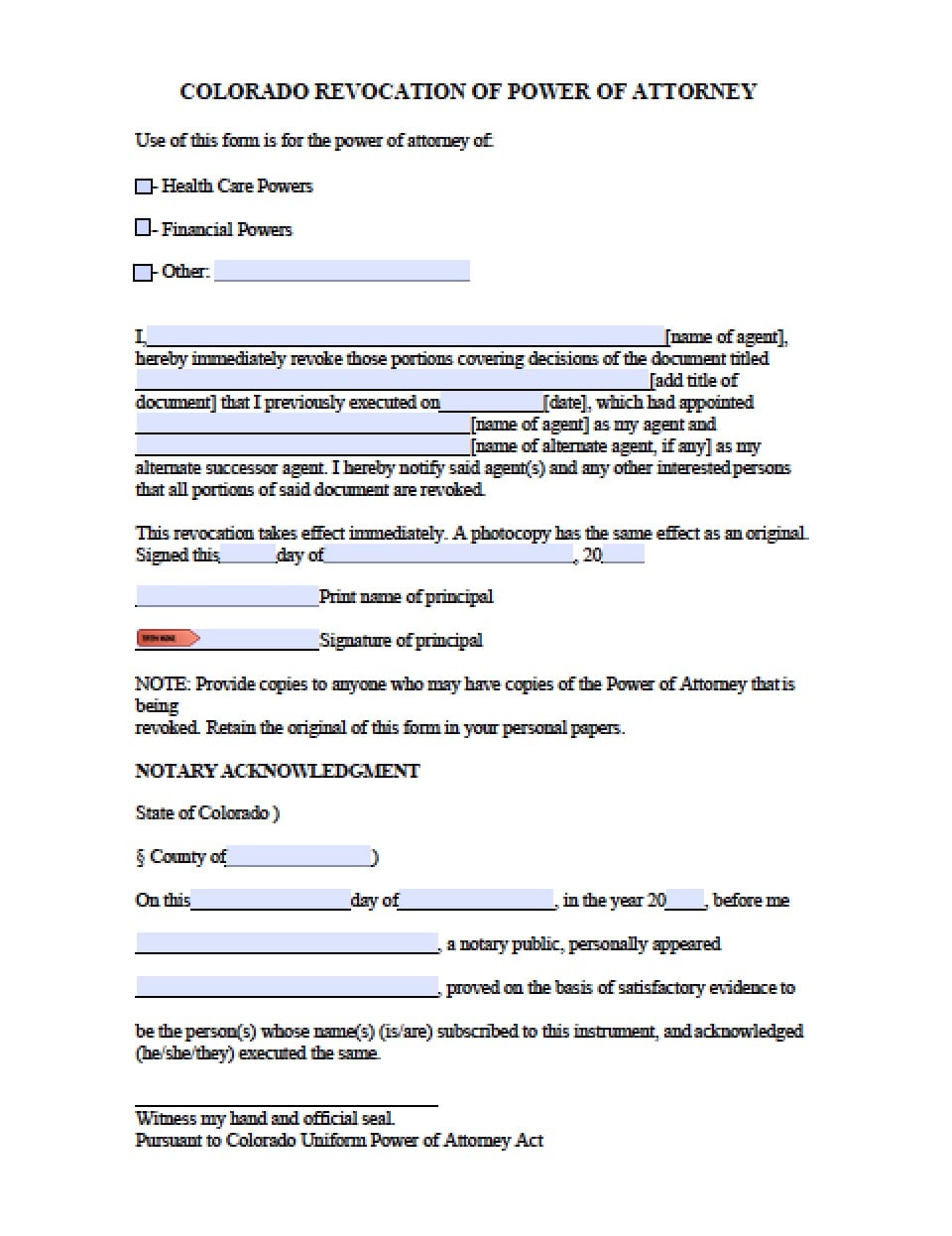

Step 8 – If you would like to use this document to also revoke all prior representations, you and your spouse (if any) must sign under the statement and provide copies of all prior representative documentation, to be attached to these forms

Step 9 – Complete the following, if known (for routing purposes only).

- You may otherwise mail this document to:

- Colorado Department of Revenue Denver, CO 80261-0009

- OR

- You may submit an electronically scanned copy of this document through the Revenue Online services at, www.Colorado.gov/RevenueOnline

Step 10 – Review all of the information provided within this document and be certain all signatures are in place as, if this document is not properly signed, it will be returned and you will have to begin again with this process.