| California Tax Power of Attorney Form |

The California tax power of attorney form is a declaration form ( FTB 3520) to grant authority to an individual to receive confidential tax information, or to represent you before the Internal Revenue Service and/or California state tax department. You can also use this form to authorize an individual to receive information from our nontax programs, such as Court-Ordered Debt Collections, Vehicle Registration and other tax related issues. There are three instructional pages in the form of tax related legalese if you need to clarify any of the information provided. Provide all required information in this form and provide copies to all interested parties mentioned within this document.

How To Write

Step 1 – Begin by downloading the document and provide – Taxpayer Information –

- Taxpayer Name

- Middle Initial

- Last Name

- Social Security Number or ITIN

- Address (suite, room, PO Box, or PMB No Mar w address)

- Telephone Number

- City

- State

- ZIP Code

Step 2 – Fiduciary (Estate) Information – Provide the following:

- Estate or Trust Name

- Social Security Number or ITIN

- FEIN

- Address (suite, room, PO Box, or PMB Number)

- Mark box if this is a new address

- Telephone Number

- City

- State

- ZIP Code

Step 3 – Business Entity Information – Provide the following information:

- Business Name

- CA Corp Number

- Address (suite, room, PO Box, or PMB Number)

- Mark box if this is a new address

- FEIN

- CA SOS Number

- City

- State

- ZIP Code

- Telephone Number

- Fax Number

Step 4 – Appointment of Representative – check all boxes and provide all required information:

- Primary Representative Information (Mark box if new – Address – Telephone Number)

- Email To appoint additional representatives attach a list including all required information to this form

- Name IRS CAF Number

- PTIN

- Physical Address (suite, room, PO Box, or PMB Number)

- Telephone Number

- Fax Number

- City

- State

- ZIP Code

- Email Address: (you must include your representative’s email address to ensure they receive email notifications)

- In the next section, if you’re appointing an additional representative, provide all of the above information, identically in the following section

Step 5 – Authorization of Tax Years and/or limited periods

- By clicking the box provided under this section, you are authorizing services from your appointees for 4 years unless revoked

Step 6 – Calendar Years for Representative(s) – Enter the tax year in which you require representation. These will be the only years they will be able to represent you so be certain you have all of the year you require representation –

- Enter the years from and through you require representation

Step 7 – Fiscal and Short-Period Income Years – In the boxes provided in this section, enter the beginning and ending year in each box. If there are more years required, add a list on a separate sheet attached to the form

Step 8 – Authorize the representative(s) listed to perform additional selected acts – Check the following boxes that apply –

- Add another representative

- Delete a representative

- Receive, but not endorse, refund check

- Other acts, specifically described: (Specify on the line provided)

Step 9 – Individuals Only – Authority To Sign Your Tax Return- This section specifies whether or not your representative is allowed by you to sign your return. Check the boxes that apply-

- Incapacitating disease or injury

- Continuous absence from the United States (including Puerto Rico) for a period of at least 60 days prior to the date required by law for filing the tax return.

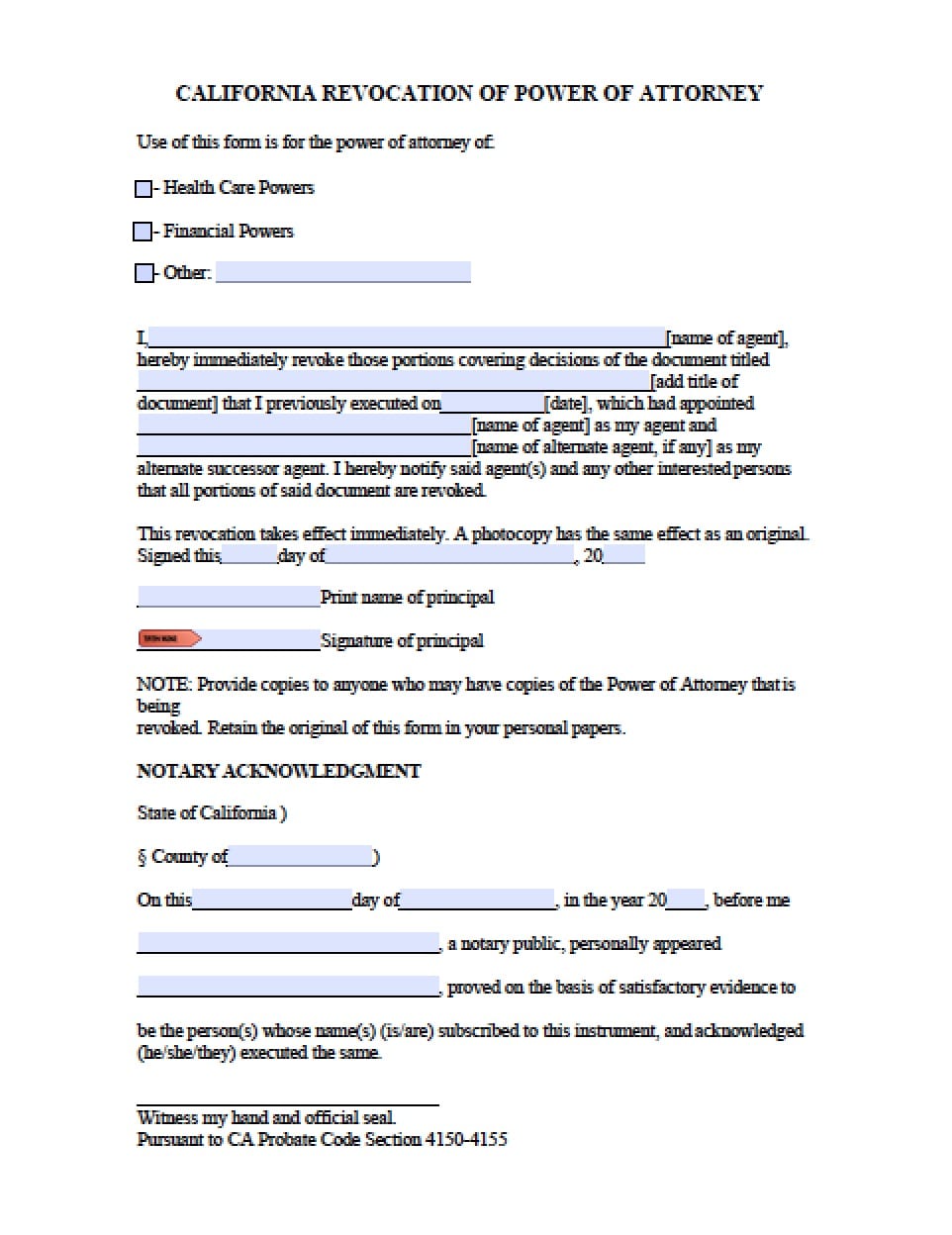

Step 10 – Retention or Revocation of Prior power of attorney – When you file this power of attorney, you will immediately revoke all earlier filed forms (See Part 5 – additional privileges) or all tax years or income periods you have indicated (Part 4 – Tax Years or Income Periods Covered by the document). To expedite your revocation of past forms, see instructions.

- Mark the box on the form if you wish to retain a prior power of attorney. You are required to attach a copy of any previous document(s) you choose to remain in effect.

Step 11 – Non-Tax Issues – Mark the box that applies – If you complete this document for nontax issues only, you need not complete the rest of this form. Go directly to Part 9 – Signature Authorizing a power of attorney, sign, and date the form

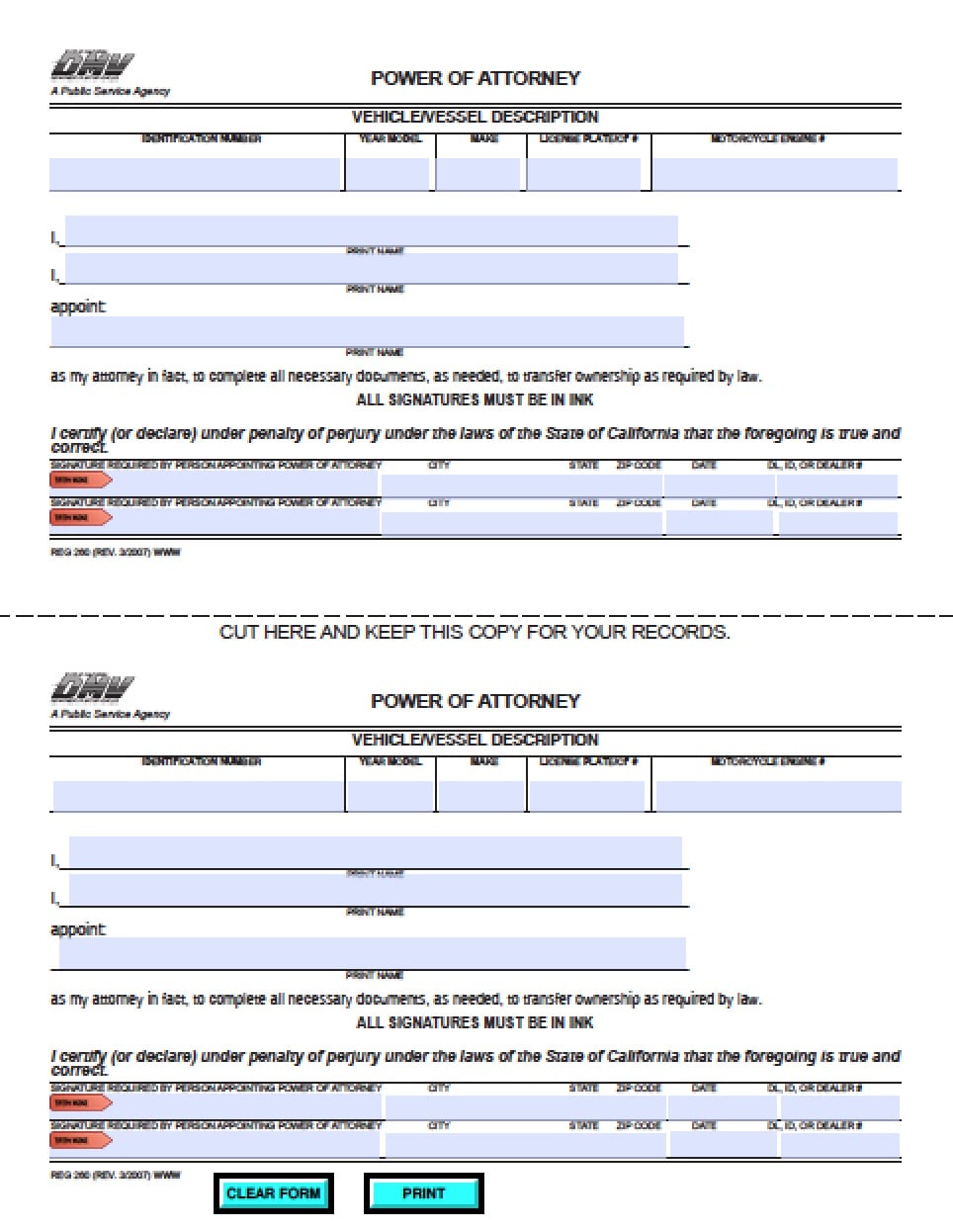

- Vehicle registration

- Court-ordered debt

Step 12 – Authorization to Receive Confidential Information Only –

- Mark this box in this section, if you’re only authorizing your representative to receive your confidential information for the specific tax year or income periods listed but they will act as your attorney-in-fact. You may not select this option if you marked the box in Part 3 – Authorization is for All Tax Years or Income Periods for a Limited Duration.

Step 13 – List the calendar years in which you require assistance in the line provided

Step 14 – Fiscal and Short-Period Income Years – enter the years to begin and end in the boxes provided –

- To list additional income years attach a list including all required information to this form

Step 15 – Signature and Authorization –

- If you are a corporate officer, partner, guardian, tax matters representative, executor, receiver, administrator, or trustee working on behalf of the principal (taxpayer) you certify you have the authority to execute this action by signing the document on behalf of the taxpayer(s). Provide the following:

- Print name

- Date of signing of the document

- Signature

- Title – This is required for fiduciaries and business entities

- Be certain you are provided with copies for your records