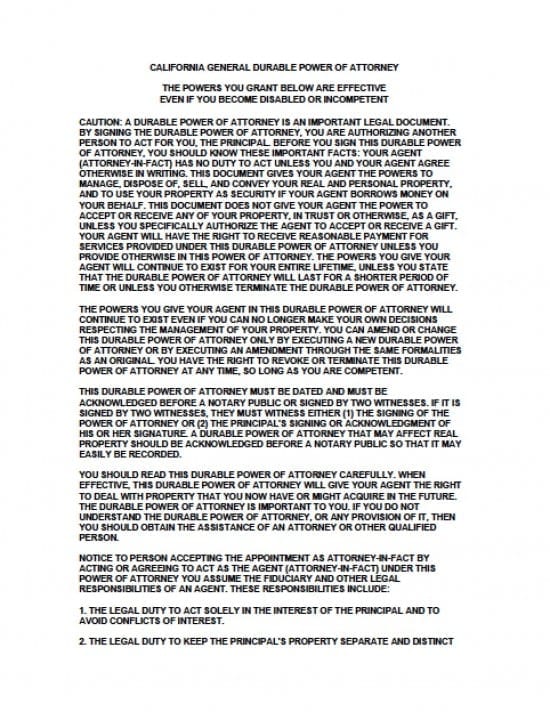

| California General Financial Power of Attorney Form |

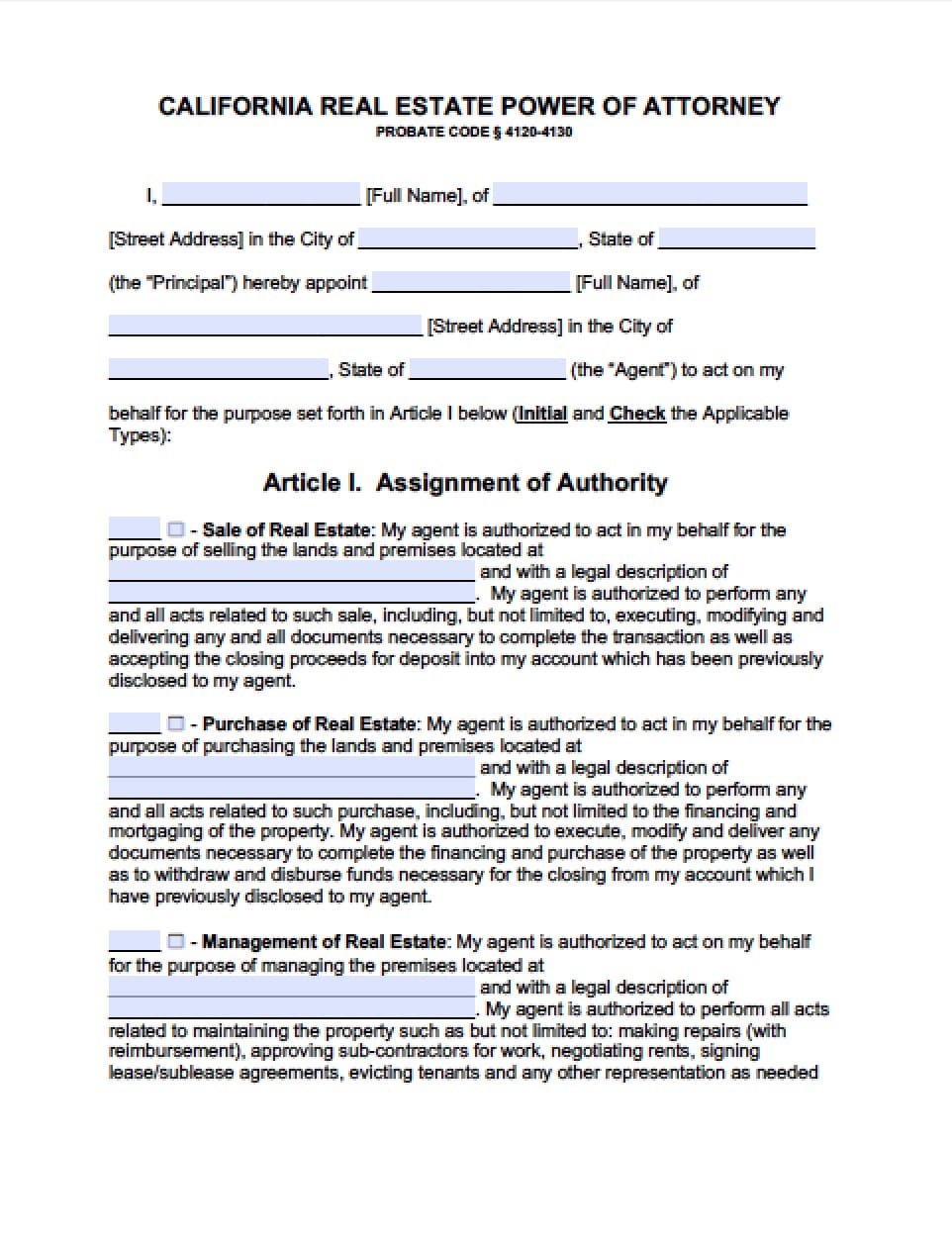

The California general financial power of attorney form is a document that allows another person to act on your behalf on many levels. It’s very important that you understand the amount of power over your property prior to completing and signing this document. If you are at any time, uncertain about what you’re reading or signing, it would be in your best interest to consult with a knowledgeable attorney. Proceed with caution as you complete and sign this document. This document may be revoked at any time by placing it in writing and providing copies to your Attorney in Fact/Agent. (See California Codes 4120-4130)

How To Write

Step 1 – Begin by downloading the form and carefully reviewing all of the information presented at the beginning of this document. Once you (principal) and your selected Attorney in Fact/Agent have reviewed the information, there is a notice at the end of the information that the Attorney in Fact, must sign stating that they intend to always work in your (the principal’s) best interest. There is also an outline of consequences if illegal activity is reported. This section must be signed by the Attorney in Fact/Agent.

Step 1 – Agent must provide signature at the end of the information provided at the beginning of this document

- Agent must provide their printed name

Step 2 – The Principal must be advised that the powers granted in this document are in force immediately and will remain effective even if you become incapacitated, disabled or incompetent. If you, as the principal wish to continue with completion and use of this document, provide the following:

- Principal’s name and physical address

- Attorney in Fact’s/Agent’s name and address as your appointee

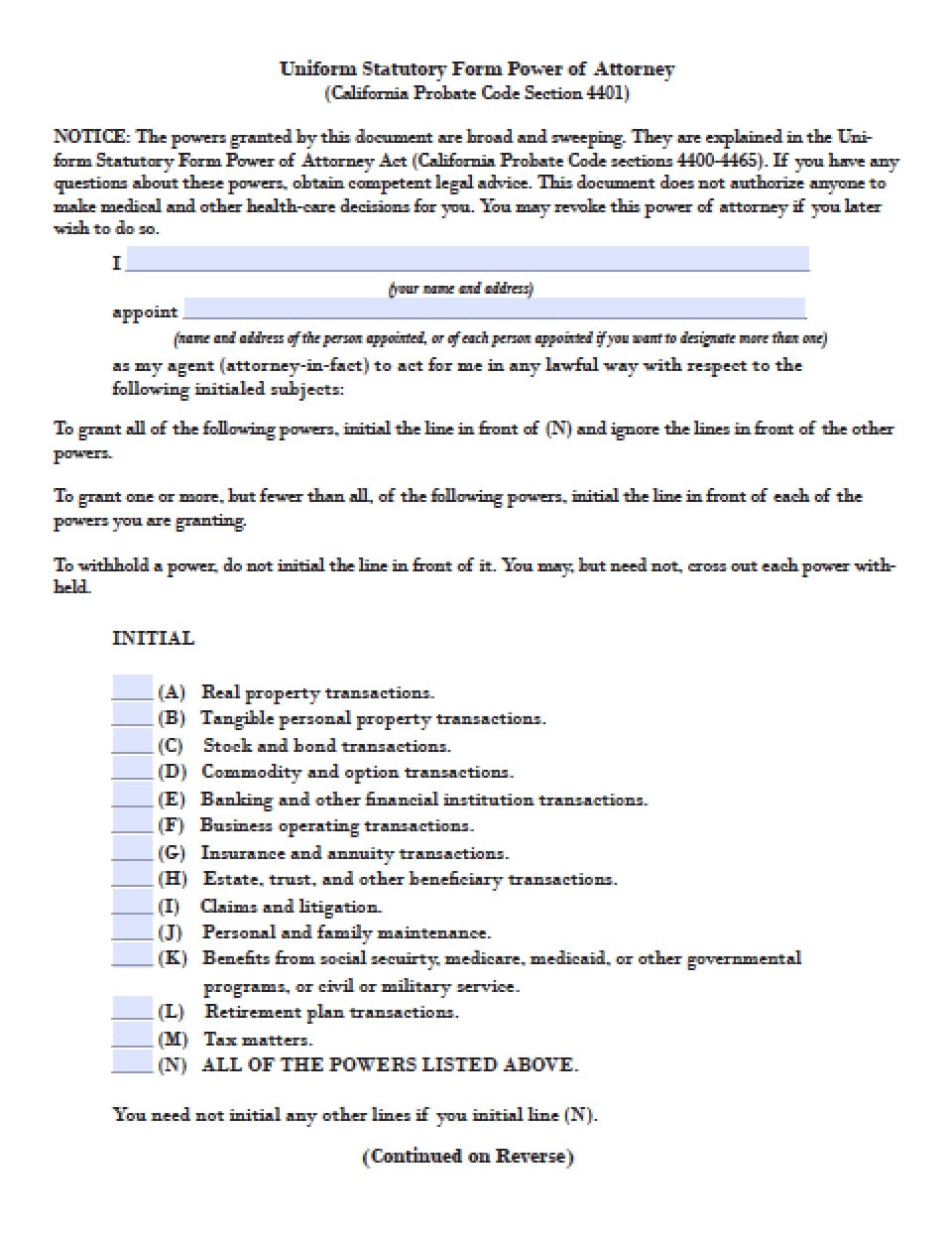

Step 3 – There are 13 paragraphs which must be reviewed and initialed by the Principal with regard to the powers allowed to the Attorney in Fact/Agent. Read them carefully. If the Principal initials A or B, notarization will be required at the end of the document. Read and initial the following selections. You do not have to initial all of them. If you choose to allow complete power to your agent, you may simply go to the end of the list and initial the line granting complete power over your property. No health decisions may be made by your agent with this document. Again, this document may be revoked at any time.

- (A) Real property transactions

- (B) Tangible personal property transactions

- (C) Stock and bond transactions

- (D) Commodity and option transactions

- (E) Banking and other financial institution transactions

- (F) Business operating transactions

- (G) Insurance and annuity transactions

- (H) Estate, trust, and other beneficiary transactions

- (I) Claims and litigation

- (J) Personal and family maintenance

- (K) Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- (L) Retirement plan transactions

- (M) Tax matters

- (N) All of the powers listed above – If you initial here, you do not need to provide initials to any of the above powers

Step 4 – Special Instructions – On the lines provided you may limit or extend powers to your Attorney in Fact/Agent. If more room is required, add a sheet with additional information and attach it to this form. Be certain to read all of the following information prior to proceeding.

Step 5 – Successor Agent – In the lines provided, you may add an agent to take over the powers granted in the event your initial agent becomes unable or unwilling to execute your instructions and powers –

- Provide the name and address of your selected successor agent who will act alone only if the initial agent cannot carry out service

Step 6 – Agent’s Right to Reasonable Compensation – Unless stricken by you, your agent will have a right to compensation that is reasonable to the services rendered.

Step 7 – Signatures – Prior to providing signatures to this document, you must retain the services of a notary public. Once you’re before a notary read the paragraphs above your signature line. If you’re in agreement, provide the following:

- Date the document that you’re signing with a dd/mm/yyyy format

- Provide your signature

- Provide your Social Security Number

Step 8 – Notarization – The notary will then acknowledge the completion of the document and signatures by completing their commission information and affixing their state seal to the document.

Step 9 – Acknowledgement of Agent – Your agent will acknowledge their responsibilities as stated by you in the pages of this document by reading the paragraph and providing the following:

- The typed or printed name of your appointed agent

- The agent’s signature

Step 10 – Preparation Statement – Whether it was yourself or any other person who prepared the document on your behalf, you/they must acknowledge who prepared the document by providing:

- Their typed or printed name

- Their signature

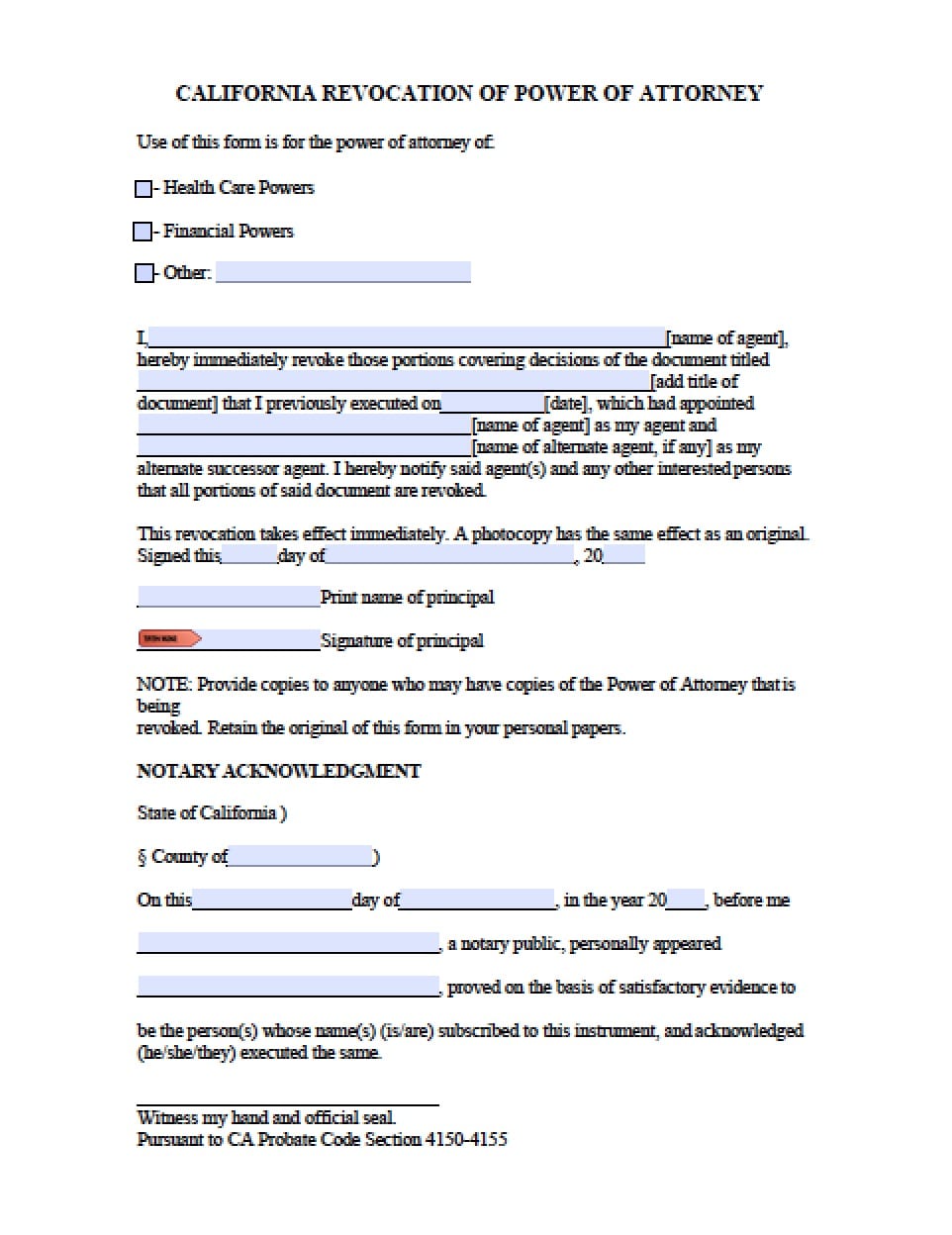

Once the document is completed you should make copies to be provided to anyone who is listed in these documents and to any financial institution who holds interest in your estate. If you decide to revoke this document, you must provide the revocation in writing to all parties involved in this document and the financial institutions you had contacted previously.