| California Durable Financial Power of Attorney Form |

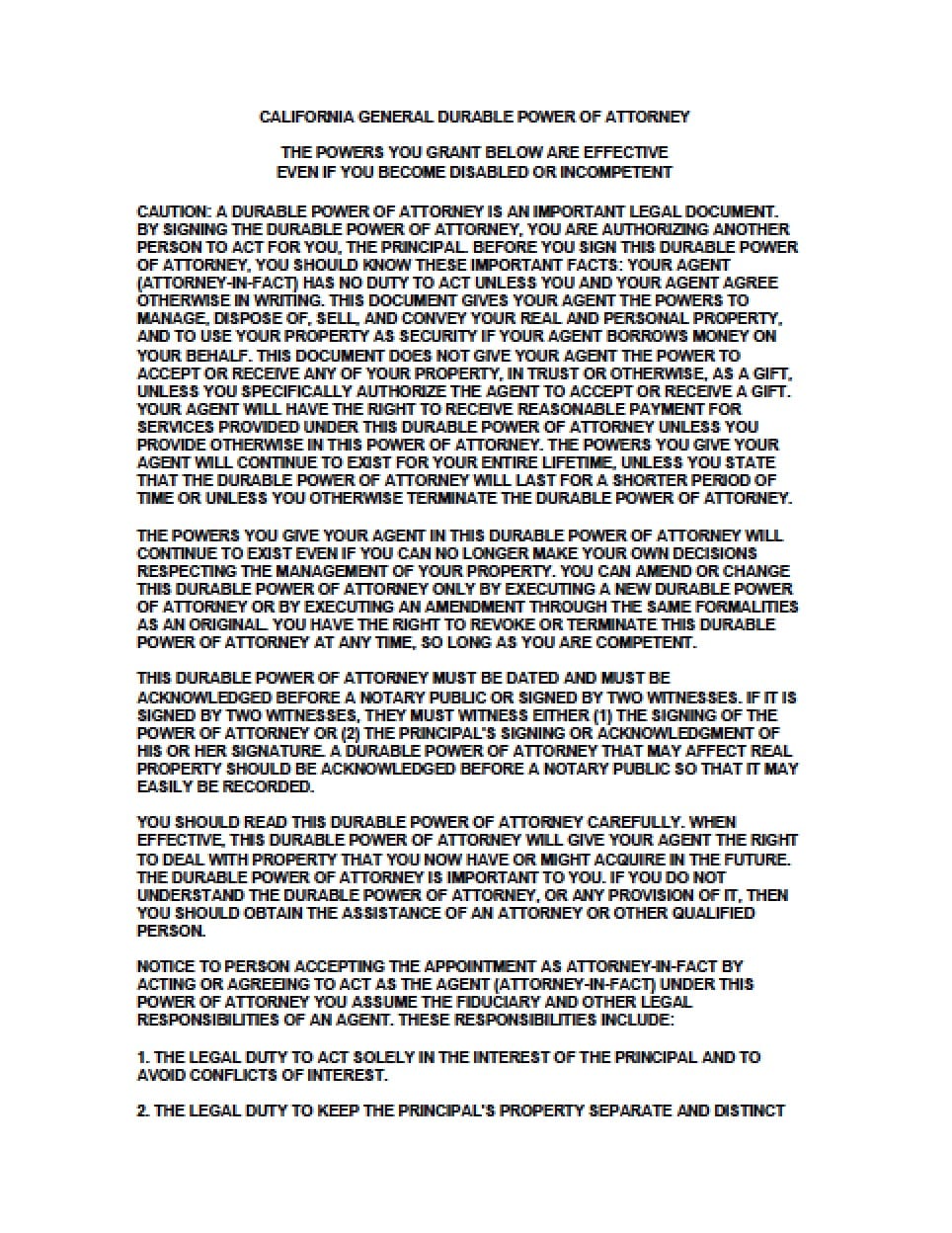

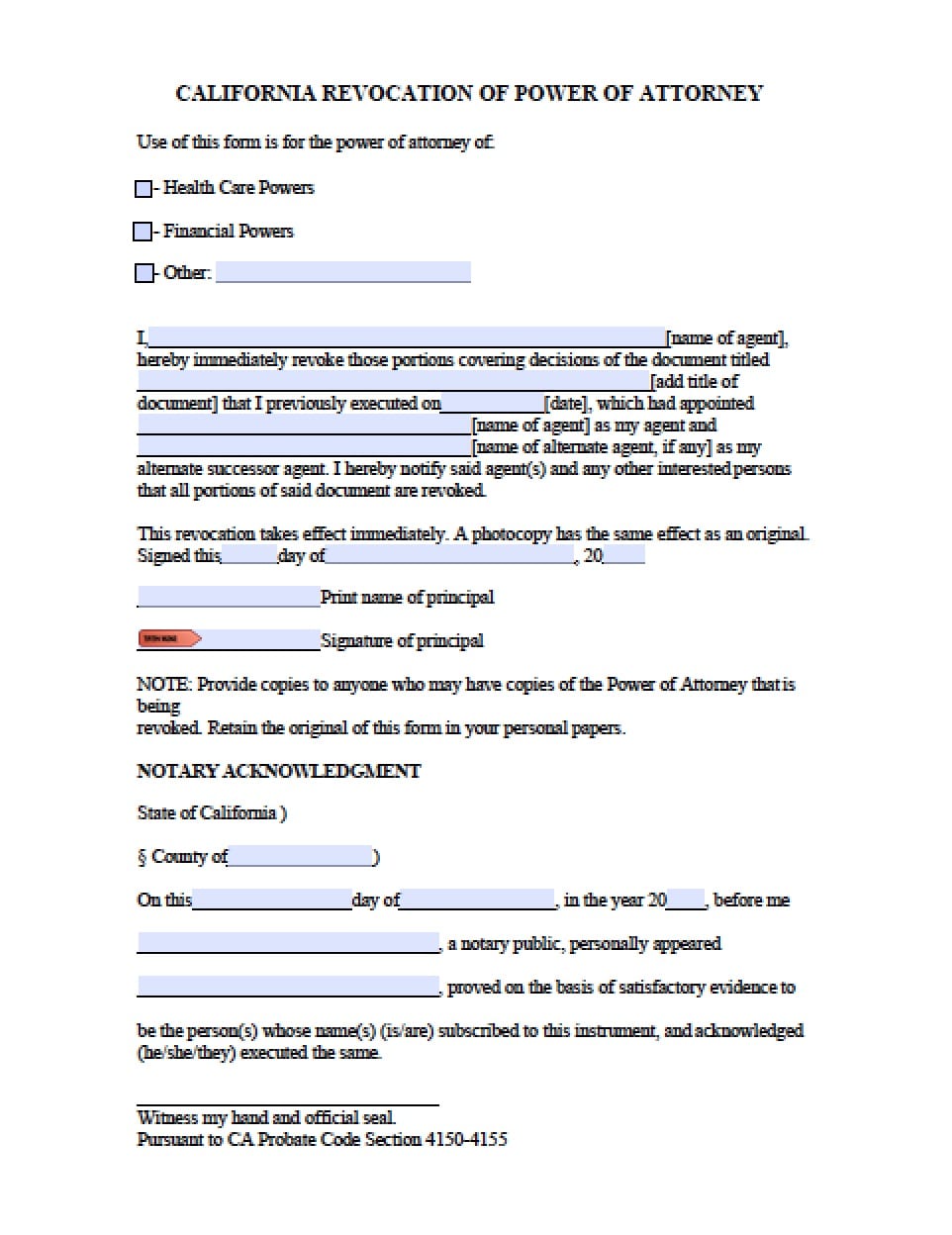

The California durable financial power of attorney form is a document that allows someone trusted by the principal to authorize the execution of all monetary decisions on his or her behalf. The Principal is required to complete the form and authorize all decisions before a public notary in order for the document to be considered legal and enforceable. CA Prob Code § 4402(c). Inasmuch as these powers are broad with little limitation, if you as the principal, are unsure with regard to what you’re selecting and signing, you may wish to consult with a knowledgeable attorney. This document is subject to the principal’s revocation at any time, in writing and deliverable to the Attorney(s) in Fact/Agent(s).

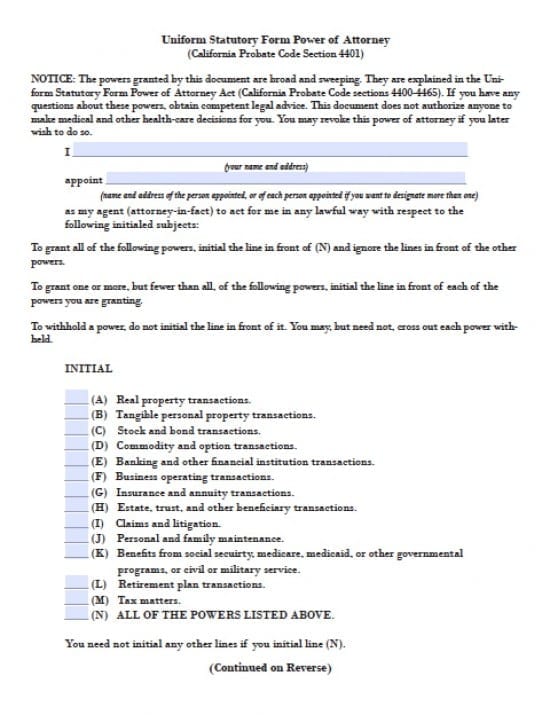

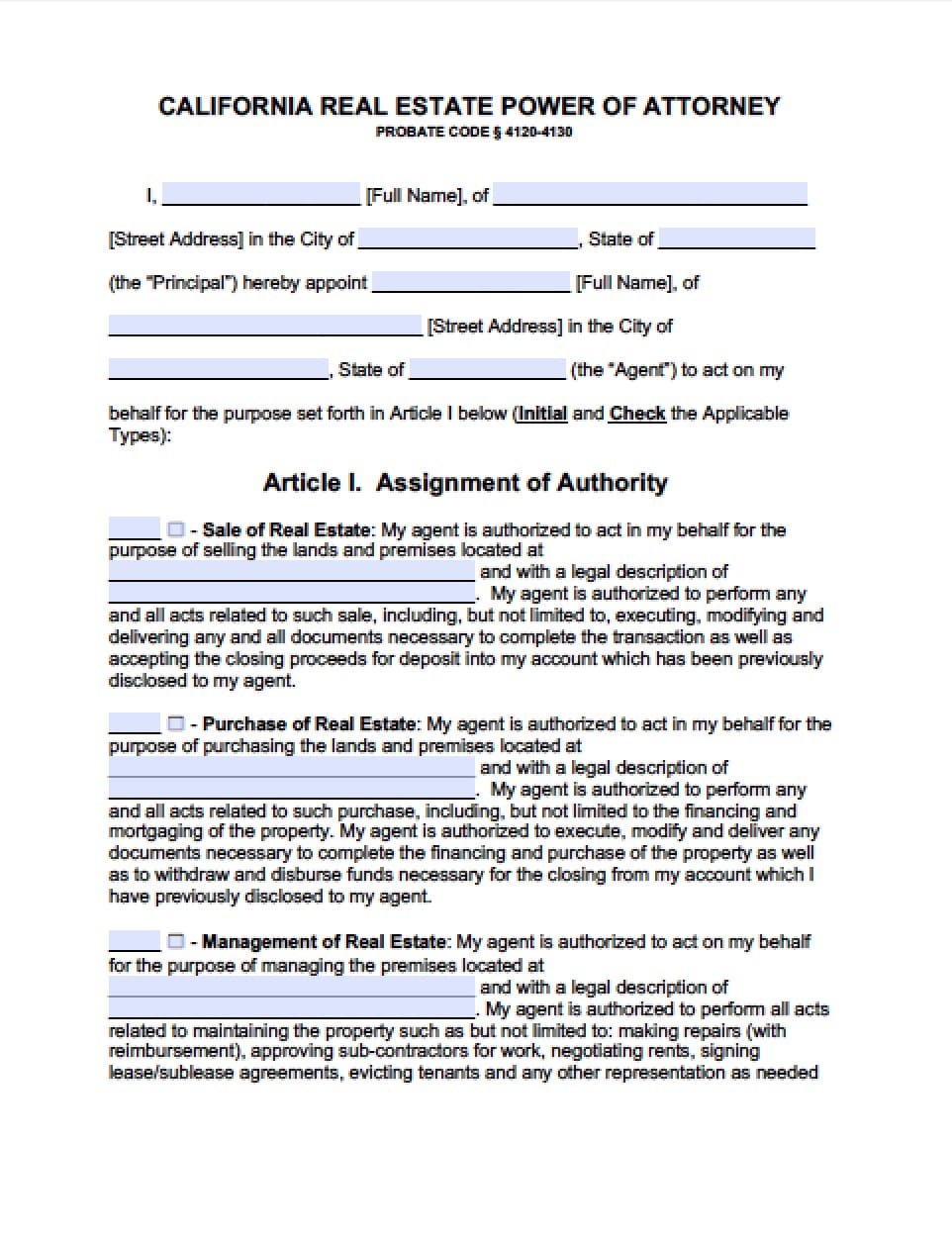

Step 1 – Appointment of Attorney in Fact(s)/Agent (s) –

- Enter the name of the Principal

- Enter the physical address of the Principal

- Enter the name of the selected Attorney in Fact/Agent

- Enter the physical address of the selected Attorney in Fact/Agent

- You have the option to appoint two more Successor Attorney(s) in Fact/Agent(s) in the event the first becomes unable or unwilling to serve. Should you decide to appoint one or two successors:

- Enter their names and physical addresses exactly as you did your initial Attorney in Fact/Agent into their respective lines within the first page of the document

Step 2 – Read the paragraphs –

- You would then initial the all of the powers allowed by you for the Attorney(s) in Fact/ Agent(s) to carry out in your absence. Initial any or all of the following: (If you wish to grant all powers, simply initial the bottom option to grant all powers)

- Real Property transactions

- (B) Tangible personal property transactions

- (C) Stock and bond transactions

- (D) Commodity and option transactions

- (E) Banking and other financial institution transactions

- (F) Business operating transactions

- (G) Insurance and annuity transactions

- (H) Estate, trust, and other beneficiary transactions

- (I) Claims and litigation

- (J) Personal and family maintenance

- (K) Benefits from social security, medicare, medicaid, or other governmental programs, or civil or military service

- (L) Retirement plan transactions

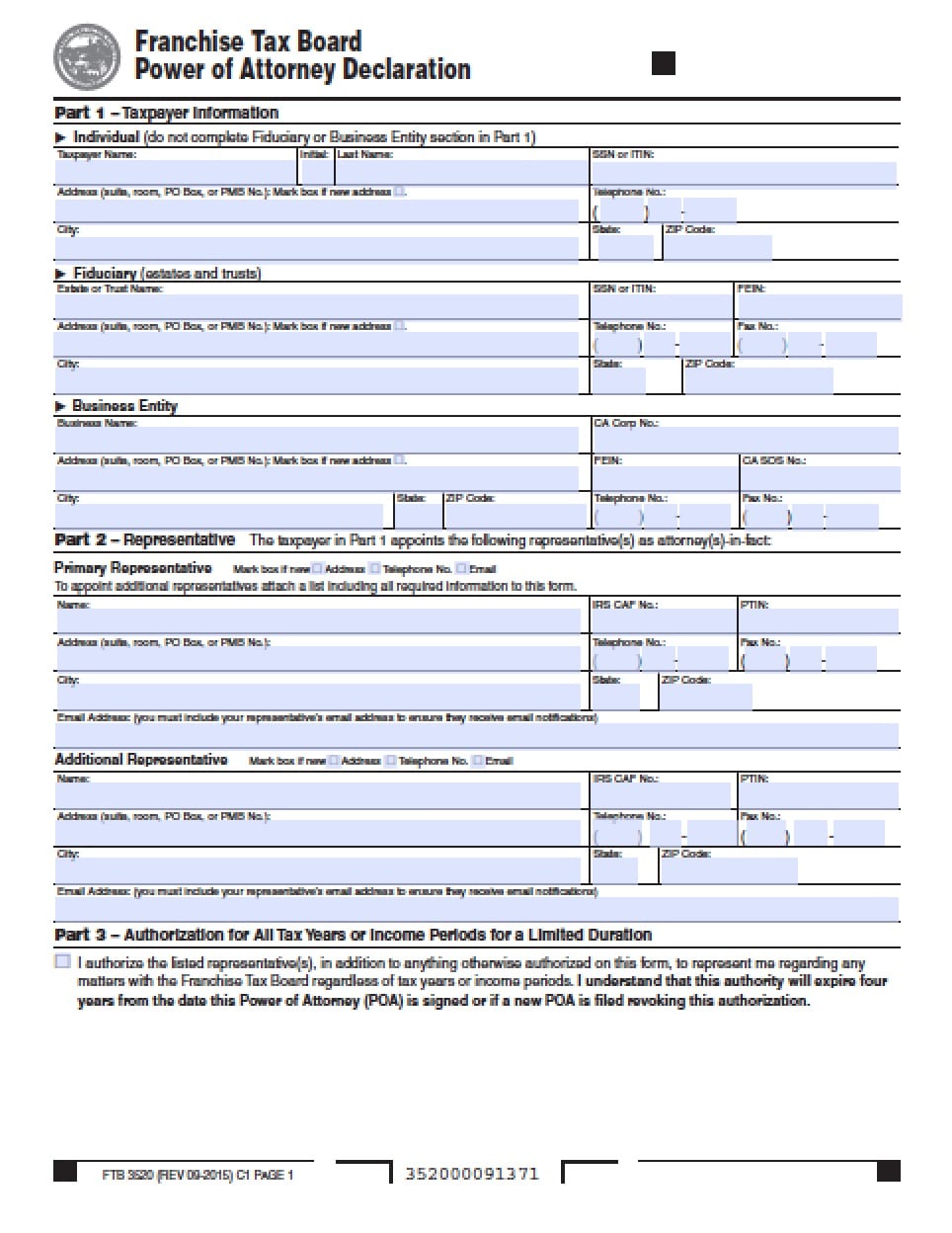

- (M) Tax matters

- (N) ALL OF THE POWERS LISTED ABOVE

Step 3 – If you have any special powers that you would like to grant to your Attorney in Fact/Agent, only in the event and not to be exercised in the event of your incapacity, state them on the lines provided. Be as specific as you possibly can. If you require additional space, add a sheet continuing your special, specific instructions and attach to this form.

Step 4 – The next two paragraphs address the definition of “incapacity” by two licensed physicians. This document may also address the act of health care provisions by your Attorney in Fact/Agent in the event you are no longer able to care for yourself. However, a separate health care directive form MUST be completed and witnessed and must be attached to this document in order for health care decisions to be made by your Attorney in Fact/Agent. If you do not want this document to continue after you become incapacitated, strike the preceding sentence(s)

Step 5 – If you appoint more than one Agent in Fact/Agent to act on your behalf, you must state specifically, if you would like them to act one without the other or together.

Step 6 – Notarization – You must retain the services of a notary public in order to legally sign and complete the legitimacy of this document.

- Once you are before a notary date the signature of this document in dd/mm/yyyy format

- The remainder of the document must be completed by the notary and they must affix their state seal

- The notary will hand the document back to the principal

- Make copies for all parties named on this document

- Make copies to be distributed to all fiduciary institution with any interest