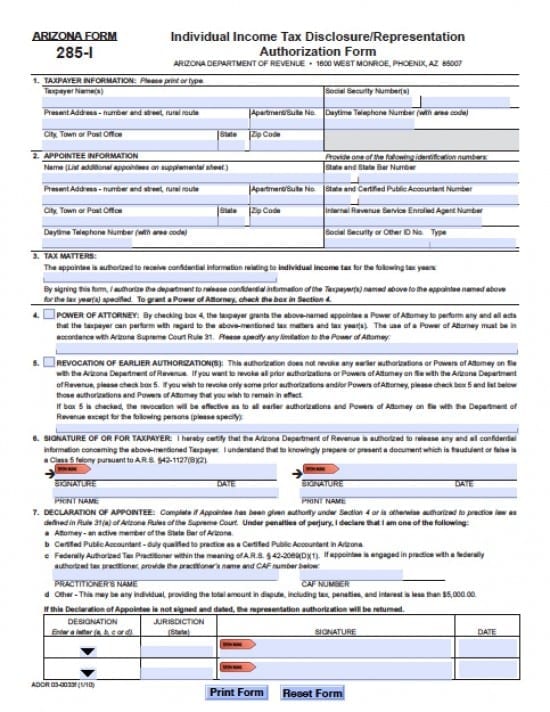

| Arizona Tax Power of Attorney Form |

The Arizona tax power of attorney form is a document required as written authorization with respect to disclosure of tax information to a designee of a taxpayer. Due to the confidential nature of tax documents, the department does require that the authorization be a power of attorney according to § 43-303. This will allow a tax preparation professional to acquire needed tax information so that they may properly calculate and complete your tax form(s). If the preparation professional is a Federally Authorized Tax Practitioner, they must meet the description of the definition outlined in A.R.S. § 42-2069(D)(1).

How To Write

Step 1 – Taxpayer Information – Download the form and begin by completing the information required in the first section of the form

- Enter the taxpayer(s) name(s)

- Social Security Number(s)

- Present physical address

- Apartment or Suite Number

- Daytime area code and telephone number

- City, Town and/or Post Office

- State, Zip Code

Step 2 – Appointee Information – Enter the following information with regard to your appointee as follows:

- Name of Appointee – if there are additional names and information, add them on a separate sheet to be attached with this form

- Appointee’s physical address

- Apartment or Suite number

- City, Town or Post Office

- State, Zip Code

- Area code with daytime telephone number

- Provide one of the following identification numbers:

- State and State Bar Number or

- State and Certifi ed Public Accountant Number or

- Internal Revenue Service Enrolled Agent Number or

- Social Security or Other ID No. If “other” what type

Step 3 – Tax Matters –

- Enter the tax years to be addressed

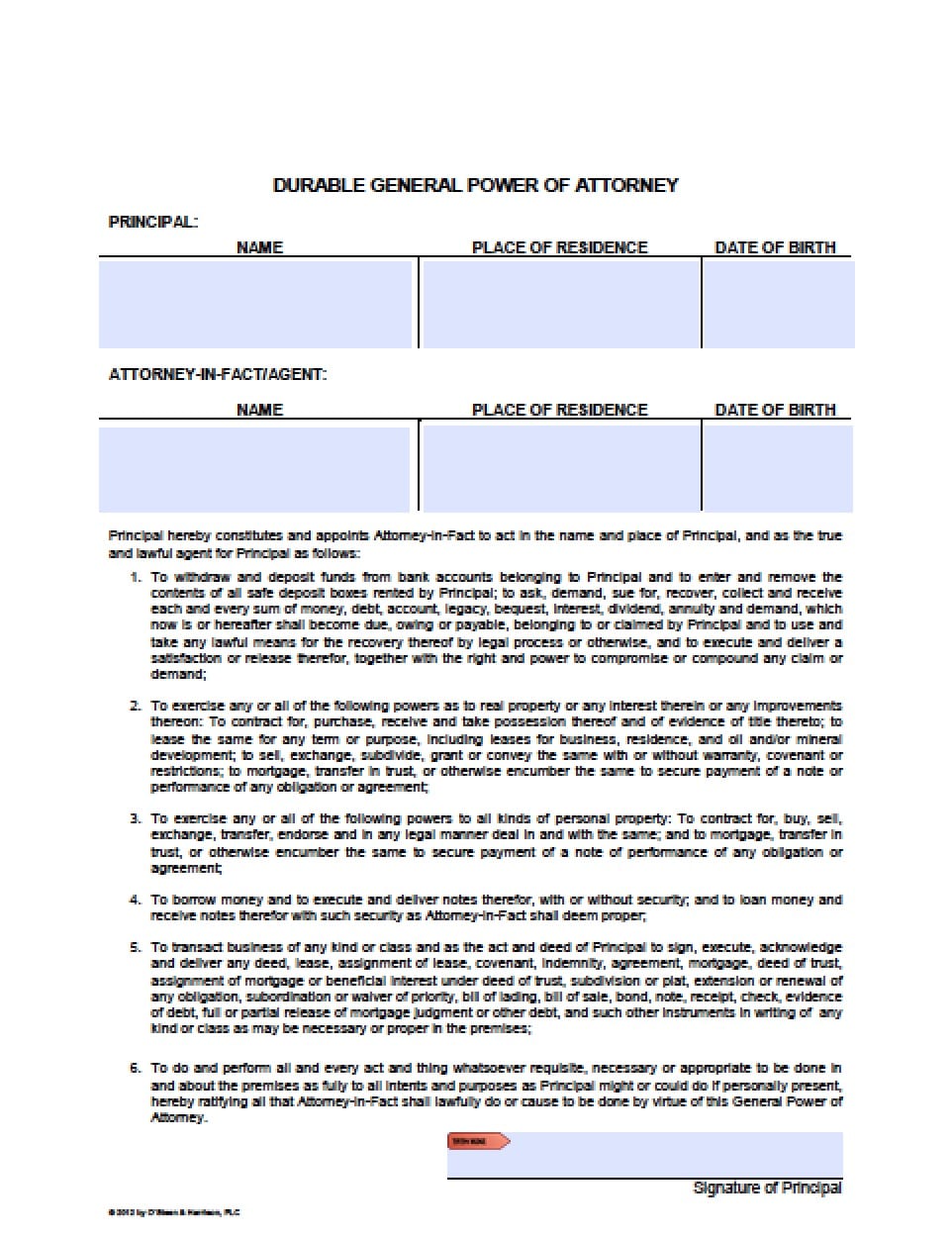

Step 4 – power of attorney – If you are a taxpayer granting power to your appointee as stated on the form:

- Check the box in section 4

Step 5 – Revocation of Earlier Authorizations – If you are a tax payer that would like to revoke all previous powers of attorney:

Check the box in section 5

Step 6 – Signature of or for taxpayer(s) – In this section the taxpayer(s) must provide:

- Signatures for one or both taxpayers

- Dates of signatures

- Printed names of taxpayers

Step 7 – The remainder of the form is to be completed by your selected appointee.

- Be certain to ask for a copy of this document for your records