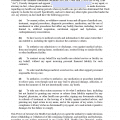

| Arkansas Tax Power of Attorney Form |

The Arkansas tax power of attorney form is a form that authorizes another person (your agent) to make decisions concerning your property for you (the principal). (See § 28-68-301) Your agent will be able to make decisions and act with respect to your property (including your money and taxes) whether or not you are able to act for yourself unless otherwise stated in writing in this form or on an added on an attached sheet. The meaning of authority over subjects listed on this form is explained in the Uniform Power of Attorney Act, Arkansas Code Title 28, Chapter 68.

How To Write

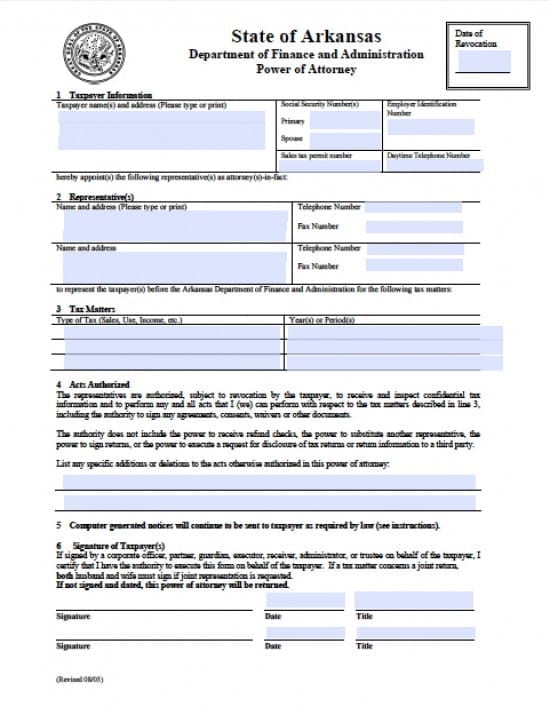

Step 1 – Taxpayer Information – begin by downloading the form and completing the first section. This section addresses only the taxpayer(s) information. Enter the following:

- At the very top right of the page, enter the date you may wish to revoke the document

- Next, enter the taxpayer(s) name(s) and physical address into the box provided

- Enter the Social Security Numbers for the primary and spouse into their respective fields

- Enter the sales tax number (if any)

- Enter the employee identification number

- Daytime telephone number

Step 2 – Representatives – This section will ask for information with regard to your selected representative(s) Provide the following:

- Name and address for each representative in their respective fields as shown

- Each representative’s telephone number

- Each representative’s Fax number

Step 3 – Tax Matter – In order for your representative(s) to have the ability to represent you before the Arkansas Department of Finance and Administration, you must next enter:

- The type of tax

- The year(s) or period(s) being addressed

Step 4 – Acts Authorized – You must read and agree to the information as stated.

- If you choose to add or delete any of the acts, list them on the lines provided in this section

Step 5 – Signature of Taxpayer(s) – Be advised that if joint representation is requested, both spouses must:

- Provide their respective signatures

- Date the form was signed

- Provide the title of each taxpayer

Be advised that if the form is not signed and dated, it will be returned to the taxpayer(s)

Step 6 – You may fax or mail the signed form to the office of whomever you’ve selected to handle the tax matter(s)